EF-502A-R01-1013-0

BOE-502-A (P3) REV. 12 (05-13)

ADDITIONAL INFORMATION

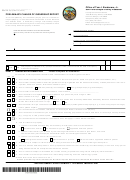

Please answer all questions in each section, and sign and complete the certification before filing. This form may be used in all 58 California

counties. If a document evidencing a change in ownership is presented to the Recorder for recordation without the concurrent filing of a

Preliminary Change of Ownership Report, the Recorder may charge an additional recording fee of twenty dollars ($20).

NOTICE: The property which you acquired may be subject to a supplemental assessment in an amount to be determined by the County

Assessor. Supplemental assessments are not paid by the title or escrow company at close of escrow, and are not included in lender

impound accounts. You may be responsible for the current or upcoming property taxes even if you do not receive the tax bill.

NAME AND MAILING ADDRESS OF BUYER: Please make necessary corrections to the printed name and mailing address. Enter

Assessor’s Parcel Number, name of seller, buyer’s daytime telephone number, buyer’s email address, and street address or physical

location of the real property.

NOTE: Your telephone number and/or email address is very important. If there is a question or a problem, the Assessor needs

to be able to contact you.

MAIL PROPERTY TAX INFORMATION TO: Enter the name, address, city, state, and zip code where property tax information should be

mailed. This must be a valid mailing address.

PRINCIPAL RESIDENCE: To help you determine your principal residence, consider (1) where you are registered to vote, (2) the home

address on your automobile registration, and (3) where you normally return after work. If after considering these criteria you are still

uncertain, choose the place at which you have spent the major portion of your time this year. Check YES if the property is intended as

your principal residence, and indicate the date of occupancy or intended occupancy.

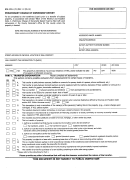

PART 1: TRANSFER INFORMATION

If you check YES to any of these statements, the Assessor may ask for supporting documentation.

C,D,E, F: If you checked YES to any of these statements, you may qualify for a property tax reassessment exclusion, which may allow you

to maintain your property’s previous tax base. A claim form must be filed and all requirements met in order to obtain any of these

exclusions. Contact the Assessor for claim forms. NOTE: If you give someone money or property during your life, you may be subject

to federal gift tax. You make a gift if you give property (including money), the use of property, or the right to receive income from property

without expecting to receive something of at least equal value in return. The transferor (donor) may be required to file Form 709, Federal

Gift Tax Return, with the Internal Revenue Service if they make gifts in excess of the annual exclusion amount.

G: Check YES if the reason for recording is to correct a name already on title [e.g., Mary Jones, who acquired title as Mary J. Smith, is

granting to Mary Jones]. This is not for use when a name is being removed from title.

H: Check YES if the change involves a lender, who holds title for security purposes on a loan, and who has no other beneficial interest

in the property.

"Beneficial interest" is the right to enjoy all the benefits of property ownership. Those benefits include the right to use, sell,

mortgage, or lease the property to another. A beneficial interest can be held by the beneficiary of a trust, while legal control of the

trust is held by the trustee.

I: A "cosigner" is a third party to a mortgage/loan who provides a guarantee that a loan will be repaid. The cosigner signs an agreement

with the lender stating that if the borrower fails to repay the loan, the cosigner will assume legal liability for it.

M: This is primarily for use when the transfer is into, out of, or between legal entities such as partnerships, corporations, or limited liability

companies. Check YES only if the interest held in each and every parcel being transferred remains exactly the same.

N: Check YES only if property is subject to subsidized low-income housing requirements with governmentally imposed restrictions;

property may qualify for a restricted valuation method (i.e., may result in lower taxes).

O: If you checked YES, you may qualify for a new construction property tax exclusion. A claim form must be filed and all requirements

met in order to obtain the exclusion. Contact the Assessor for a claim form.

PART 2: OTHER TRANSFER INFORMATION

A: The date of recording is rebuttably presumed to be the date of transfer. If you believe the date of transfer was a different date (e.g., the

transfer was by an unrecorded contract, or a lease identifies a specific start date), put the date you believe is the correct transfer date. If

it is not the date of recording, the Assessor may ask you for supporting documentation.

B: Check the box that corresponds to the type of transfer. If OTHER is checked, please provide a detailed description. Attach a separate

sheet if necessary.

A002-213

1

1 2

2 3

3 4

4