EF-502A-R01-1013-0

BOE-502-A (P4) REV. 12 (05-13)

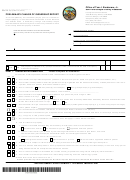

PART 3: PURCHASE PRICE AND TERMS OF SALE

It is important to complete this section completely and accurately. The reported purchase price and terms of sale are important factors in

determining the assessed value of the property, which is used to calculate your property tax bill. Your failure to provide any required or

requested information may result in an inaccurate assessment of the property and in an overpayment or underpayment of taxes.

A. Enter the total purchase price, not including closing costs or mortgage insurance.

“Mortgage insurance” is insurance protecting a lender against loss from a mortgagor’s default, issued by the FHA or a private

mortgage insurer.

B. Enter the amount of the down payment, whether paid in cash or by an exchange. If through an exchange, exclude the closing costs.

“Closing costs” are fees and expenses, over and above the price of the property, incurred by the buyer and/or seller, which

include title searches, lawyer’s fees, survey charges, and document recording fees.

C. Enter the amount of the First Deed of Trust, if any. Check all the applicable boxes, and complete the information requested.

A “balloon payment” is the final installment of a loan to be paid in an amount that is disproportionately larger than the regular

installment.

D. Enter the amount of the Second Deed of Trust, if any. Check all the applicable boxes, and complete the information requested.

E. If there was an assumption of an improvement bond or other public financing with a remaining balance, enter the outstanding balance,

and mark the applicable box.

An “improvement bond or other public financing” is a lien against real property due to property-specific improvement

financing, such as green or solar construction financing, assessment district bonds, Mello-Roos (a form of financing that can be

used by cities, counties and special districts to finance major improvements and services within the particular district) or general

improvement bonds, etc. Amounts for repayment of contractual assessments are included with the annual property tax bill.

F. Enter the amount of any real estate commission fees paid by the buyer which are not included in the purchase price.

G. If the property was purchased through a real estate broker, check that box and enter the broker’s name and phone number. If the

property was purchased directly from the seller (who is not a family member of one of the parties purchasing the property), check the

“Direct from seller” box. If the property was purchased directly from a member of your family, or a family member of one of the parties who

is purchasing the property, check the “From a family member” box and indicate the relationship of the family member (e.g., father, aunt,

cousin, etc.). If the property was purchased by some other means (e.g., over the Internet, at auction, etc.), check the “OTHER” box and

provide a detailed description (attach a separate sheet if necessary).

H. Describe any special terms (e.g., seller retains an unrecorded life estate in a portion of the property, etc.), seller concessions (e.g.,

seller agrees to replace roof, seller agrees to certain interior finish work, etc.), broker/agent fees waived (e.g., fees waived by the

broker/agent for either the buyer or seller), financing, buyer paid commissions, and any other information that will assist the Assessor in

determining the value of the property.

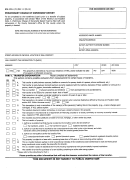

PART 4: PROPERTY INFORMATION

A. Indicate the property type or property right transferred. Property rights may include water, timber, mineral rights, etc.

B. Check YES if personal, business property or incentives are included in the purchase price in Part 3. Examples of personal or business

property are furniture, farm equipment, machinery, etc. Examples of incentives are club memberships (golf, health, etc.), ski lift tickets,

homeowners’ dues, etc. Attach a list of items and their purchase price allocation. An adjustment will not be made if a detailed list is not

provided.

C. Check YES if a manufactured home or homes are included in the purchase price. Indicate the purchase price directly attributable

to each of the manufactured homes. If the manufactured home is registered through the Department of Motor Vehicles in lieu of being

subject to property taxes, check NO and enter the decal number.

D. Check YES if the property was purchased or acquired with the intent to rent or lease it out to generate income, and indicate the source

of that anticipated income. Check NO if the property will not generate income, or was purchased with the intent of being owner-occupied.

E. Provide your opinion of the condition of the property at the time of purchase. If the property is in “fair” or “poor” condition, include a

brief description of repair needed.

A002-213

1

1 2

2 3

3 4

4