10A104 (6-11)

Page 3

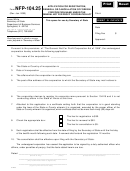

15.-16. OWNERSHIP DISCLOSURE—RESPONSIBLE PARTY UPDATE

Provide updated information for existing responsible parties or add additional responsible parties.

Full Legal Name (Last, First, Middle)

Full Legal Name (Last, First, Middle)

Residence Address

Residence Address

City

State

Zip Code

City

State

Zip Code

Social Security Number (REQUIRED)

Social Security Number (REQUIRED)

Telephone Number

Telephone Number

(

)

–

(

)

–

Business Title

Effective Date of Title

Business Title

Effective Date of Title

/

/

/

/

Does this new Responsible Party replace a previous one?

Does this new Responsible Party replace a previous one?

Yes

No

Yes

No

If yes, list the name of the previous Responsible Party and their end date.

If yes, list the name of the previous Responsible Party and their end date.

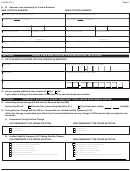

SECTION F

UPDATES TO MAILING ADDRESS AND PHONE NUMBERS FOR TAX ACCOUNTS

17. Start Date for Address Change

19. List New Mailing Address

/

/

c/o or Attn.

18. Tax Accounts for which the Address Change Applies

Address

(Check all that apply)

Employer’s Withholding Tax

Consumer’s Use Tax

Sales and Use Tax

Corporation Income Tax

City

State

Zip Code

(including Transient Room

and/or Limited Liability

and/or Motor Vehicle Tire

Entity Tax

County (if in Kentucky)

Mailing Telephone Number

Fee Accounts)

(

)

–

Coal Severance and

Processing Tax

Note: To change the address or phone number for Telecommunications Tax or Utility Gross Receipts License Tax, you must use the online system.

20. Start Date for Address Change

22. List New Mailing Address

/

/

c/o or Attn.

21. Tax Accounts for which the Address Change Applies

Address

(Check all that apply)

Employer’s Withholding Tax

Consumer’s Use Tax

Sales and Use Tax

Corporation Income Tax

City

State

Zip Code

(including Transient Room

and/or Limited Liability

and/or Motor Vehicle Tire

Entity Tax

County (if in Kentucky)

Mailing Telephone Number

Fee Accounts)

(

)

–

Coal Severance and

Processing Tax

Note: To change the address or phone number for Telecommunications Tax or Utility Gross Receipts License Tax, you must use the online system.

1

1 2

2 3

3 4

4