10A104 (6-11)

Page 4

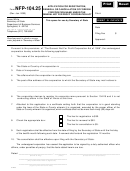

SECTION G

REQUEST CANCELLATION OF ACCOUNT(S)

23. Tax Accounts for which Cancellation is Requested

24. Reason for Cancellation

(Check all that Apply)

Business closed/No

Business sold

Employer’s Withholding Tax

Consumer’s Use Tax

further Kentucky activity

Sales and Use Tax

Coal Severance and

Ceased having employees

Ceased making retail and/or

(including Transient Room

Processing Tax

wholesale sales of tangible

and/or Motor Vehicle Tire

Death of owner

personal property or digital

Fee Accounts)

Utility Gross Receipts

property

License Tax

Converted to another

Telecommunications Tax

ownership type and must

Merged out of existence

reapply for new accounts

Note: Corporation Income and/or Limited Liability Entity Tax accounts

Other (Specify):

are cancelled with the filing of the “final” return.

_________________________

/

/

25. Effective Date to Cancel Account(s)

_________________________

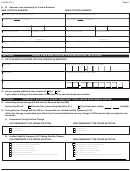

26. If business sold, list the information for the new owner(s).

Name

Name

Address

Address

City

State

Zip Code

City

State

Zip Code

Telephone Number

Telephone Number

(

)

–

(

)

–

27. If merged out of existence, list the information for the new business.

Business Name

Address

FEIN

Telephone Number

City

State

Zip Code

(

)

–

IMPORTANT: THIS UPDATE FORM MUST BE SIGNED BELOW:

The statements contained in this Form and any accompanying schedules are hereby certified to be correct to the best knowledge and belief of the undersigned who is duly

authorized to sign the Form.

Signed: ___________________________________________________________

Signed: ___________________________________________________________

Phone Number: _____________________________________________________

Phone Number: _____________________________________________________

Title: ______________________________________ Date: ____/____/______

Title: ______________________________________

Date: ____/____/______

Data Integrity Section

(502) 564-2694

For assistance in completing the Update Form, please call the

at

, or you may contact one of the Kentucky Taxpayer Service

Centers or use the Telecommunications Device for the Deaf. Each office is open Monday through Friday, 8:00 a.m. to 5:00 p.m., local time. For a list of Taxpayer Service

Centers and phone numbers, see the Instructions.

MAIL completed form to:

KENTUCKY DEPARTMENT OF REVENUE

or

FAX to:

502-564-0796

P.O. BOX 299, STATION 20A

FRANKFORT, KENTUCKY 40602-0299

The Kentucky Department of Revenue does not discriminate on the basis of race,

color, national origin, sex, religion, age or disability in employment or the provision of

services.

1

1 2

2 3

3 4

4