Sba Form 1050 - Settlement Sheet

Download a blank fillable Sba Form 1050 - Settlement Sheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Sba Form 1050 - Settlement Sheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

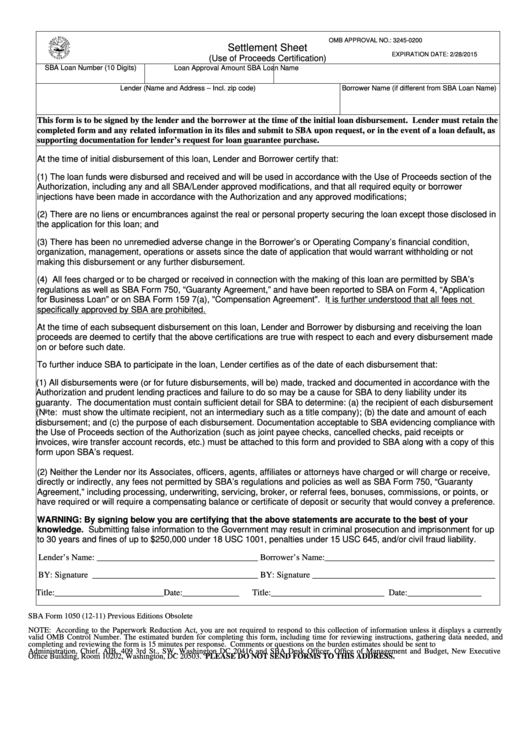

U.S. Small Business Administration

OMB APPROVAL NO.: 3245-0200

Settlement Sheet

EXPIRATION DATE: 2/28/2015

(Use of Proceeds Certification)

SBA Loan Number (10 Digits)

Loan Approval Amount

SBA Loan Name

Lender (Name and Address – Incl. zip code)

Borrower Name (if different from SBA Loan Name)

This form is to be signed by the lender and the borrower at the time of the initial loan disbursement. Lender must retain the

completed form and any related information in its files and submit to SBA upon request, or in the event of a loan default, as

supporting documentation for lender’s request for loan guarantee purchase.

At the time of initial disbursement of this loan, Lender and Borrower certify that:

(1) The loan funds were disbursed and received and will be used in accordance with the Use of Proceeds section of the

Authorization, including any and all SBA/Lender approved modifications, and that all required equity or borrower

injections have been made in accordance with the Authorization and any approved modifications;

(2) There are no liens or encumbrances against the real or personal property securing the loan except those disclosed in

the application for this loan; and

(3) There has been no unremedied adverse change in the Borrower’s or Operating Company’s financial condition,

organization, management, operations or assets since the date of application that would warrant withholding or not

making this disbursement or any further disbursement.

(4) All fees charged or to be charged or received in connection with the making of this loan are permitted by SBA’s

regulations as well as SBA Form 750, “Guaranty Agreement,” and have been reported to SBA on Form 4, “Application

for Business Loan” or on SBA Form 159 7(a), "Compensation Agreement". It is further understood that all fees not

specifically approved by SBA are prohibited.

At the time of each subsequent disbursement on this loan, Lender and Borrower by disbursing and receiving the loan

proceeds are deemed to certify that the above certifications are true with respect to each and every disbursement made

on or before such date.

To further induce SBA to participate in the loan, Lender certifies as of the date of each disbursement that:

(1) All disbursements were (or for future disbursements, will be) made, tracked and documented in accordance with the

Authorization and prudent lending practices and failure to do so may be a cause for SBA to deny liability under its

guaranty. The documentation must contain sufficient detail for SBA to determine: (a) the recipient of each disbursement

(Note: must show the ultimate recipient, not an intermediary such as a title company); (b) the date and amount of each

disbursement; and (c) the purpose of each disbursement. Documentation acceptable to SBA evidencing compliance with

the Use of Proceeds section of the Authorization (such as joint payee checks, cancelled checks, paid receipts or

invoices, wire transfer account records, etc.) must be attached to this form and provided to SBA along with a copy of this

form upon SBA’s request.

(2) Neither the Lender nor its Associates, officers, agents, affiliates or attorneys have charged or will charge or receive,

directly or indirectly, any fees not permitted by SBA’s regulations and policies as well as SBA Form 750, “Guaranty

Agreement,” including processing, underwriting, servicing, broker, or referral fees, bonuses, commissions, or points, or

have required or will require a compensating balance or certificate of deposit or security that would convey a preference.

WARNING: By signing below you are certifying that the above statements are accurate to the best of your

knowledge. Submitting false information to the Government may result in criminal prosecution and imprisonment for up

to 30 years and fines of up to $250,000 under 18 USC 1001, penalties under 15 USC 645, and/or civil fraud liability.

Lender’s Name: _____________________________________ Borrower’s Name:_______________________________________

BY: Signature ______________________________________ BY: Signature __________________________________________

Title:_________________________Date:_____________

Title:__________________________ Date:_________________

SBA Form 1050 (12-11) Previous Editions Obsolete

NOTE: According to the Paperwork Reduction Act, you are not required to respond to this collection of information unless it displays a currently

valid OMB Control Number. The estimated burden for completing this form, including time for reviewing instructions, gathering data needed, and

completing and reviewing the form is 15 minutes per response. Comments or questions on the burden estimates should be sent to U.S. Small Business

Administration, Chief, AIB, 409 3rd St., SW, Washington DC 20416 and SBA Desk Officer, Office of Management and Budget, New Executive

Office Building, Room 10202, Washington, DC 20503. PLEASE DO NOT SEND FORMS TO THIS ADDRESS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1