Entity Status Certification Form

ADVERTISEMENT

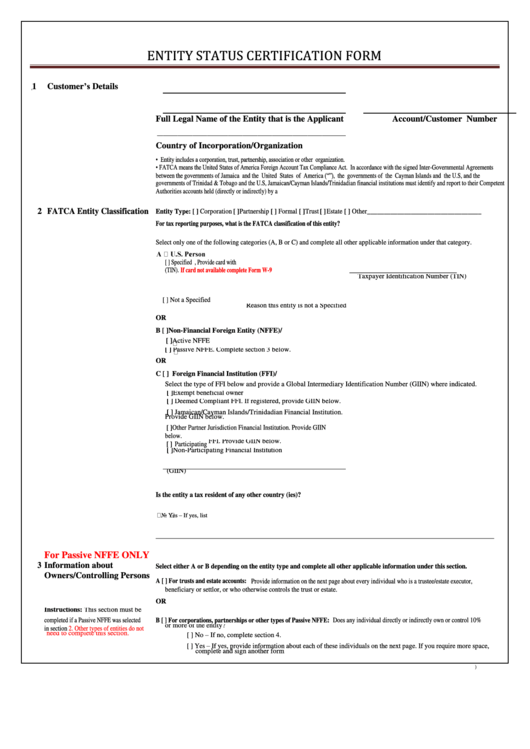

ENTITY STATUS CERTIFICATION FORM

1

Customer’s Details

Full Legal Name of the Entity that is the Applicant

Account/Customer Number

________________________________________________________________

Country of Incorporation/Organization

• Entity includes a corporation, trust, partnership, association or other organization.

• FATCA means the United States of America Foreign Account Tax Compliance Act. In accordance with the signed Inter-Governmental Agreements

between the governments of Jamaica and the United States of America (“U.S.”), the governments of the Cayman Islands and the U.S, and the

governments of Trinidad & Tobago and the U.S, Jamaican/Cayman Islands/Trinidadian financial institutions must identify and report to their Competent

Authorities accounts held (directly or indirectly) by a U.S. person.

2 FATCA Entity Classification

Entity Type: [ ]Corporation [ ]Partnership [ ] Formal [ ]Trust [ ]Estate [ ] Other__________________________________

For tax reporting purposes, what is the FATCA classification of this entity?

Select only one of the following categories (A, B or C) and complete all other applicable information under that category.

[ ] Specified U.S. Person, Provide card with U.S. Taxpayer Identification Number

(TIN).

If card not available complete Form W-9

__________________________________

Taxpayer Identification Number (TIN)

[ ] Not a Specified U.S. Person ____________________________________________________________________

Reason this entity is not a Specified U.S. person

OR

B [ ] Non-Financial Foreign Entity (NFFE)/Non-U.S. Entity

[ ] Active NFFE

[ ] Passive NFFE. Complete section 3 below.

OR

C [ ] Foreign Financial Institution (FFI)/Non-U.S. FFI

Select the type of FFI below and provide a Global Intermediary Identification Number (GIIN) where indicated.

[ ]Exempt beneficial owner

[ ] Deemed Compliant FFI. If registered, provide GIIN below.

[ ] Jamaican/Cayman Islands/Trinidadian Financial Institution.

Provide GIIN below.

[ ]Other Partner Jurisdiction Financial Institution. Provide GIIN

below.

[ ] Participating FFI. Provide GIIN below.

[ ]Non-Participating Financial Institution

(GIIN)

Is the entity a tax resident of any other country (ies)?

No Yes – If yes, list

_______________________________________________________________________________________________________

For Passive NFFE ONLY

3

Information about

Select either A or B depending on the entity type and complete all other applicable information under this section.

Owners/Controlling Persons

A [ ] For trusts and estate accounts: Provide information on the next page about every individual who is a trustee/estate executor,

beneficiary or settlor, or who otherwise controls the trust or estate.

OR

Instructions: This section must be

completed if a Passive NFFE was selected

B [ ] For corporations, partnerships or other types of Passive NFFE: Does any individual directly or indirectly own or control 10%

in section

2. Other types of entities do not

or more of the entity?

need to complete this section.

[ ] No – If no, complete section 4.

[ ] Yes – If yes, provide information about each of these individuals on the next page. If you require more space,

complete and sign another form

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4