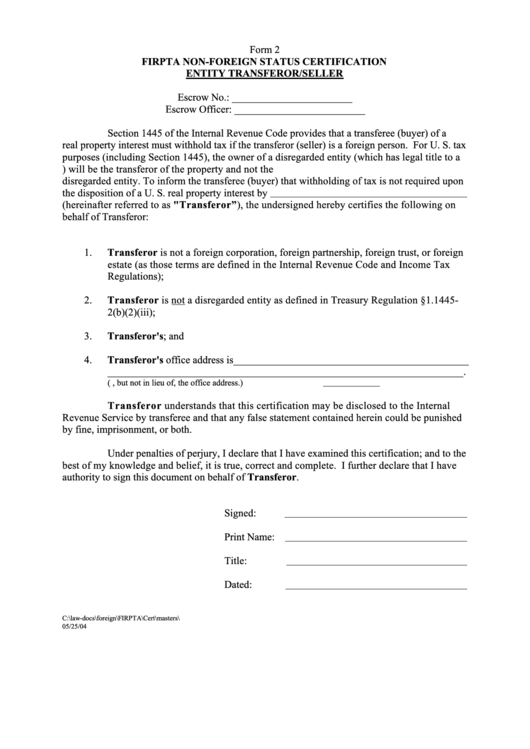

Form 2

FIRPTA NON-FOREIGN STATUS CERTIFICATION

ENTITY TRANSFEROR/SELLER

Escrow No.: _______________________

Escrow Officer: _________________________

Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S.

real property interest must withhold tax if the transferor (seller) is a foreign person. For U. S. tax

purposes (including Section 1445), the owner of a disregarded entity (which has legal title to a

U.S. real property interest under local law) will be the transferor of the property and not the

disregarded entity. To inform the transferee (buyer) that withholding of tax is not required upon

the disposition of a U. S. real property interest by

(hereinafter referred to as "Transferor”), the undersigned hereby certifies the following on

behalf of Transferor:

1.

Transferor is not a foreign corporation, foreign partnership, foreign trust, or foreign

estate (as those terms are defined in the Internal Revenue Code and Income Tax

Regulations);

2.

Transferor is not a disregarded entity as defined in Treasury Regulation §1.1445-

2(b)(2)(iii);

3.

Transferor's U.S. employer identification number is______________________; and

4.

Transferor's office address is_____________________________________________

____________________________________________________________________.

(P.O. Box and mailing address may be provided in addition to, but not in lieu of, the office address.)

Transferor understands that this certification may be disclosed to the Internal

Revenue Service by transferee and that any false statement contained herein could be punished

by fine, imprisonment, or both.

Under penalties of perjury, I declare that I have examined this certification; and to the

best of my knowledge and belief, it is true, correct and complete. I further declare that I have

authority to sign this document on behalf of Transferor.

Signed:

Print Name:

Title:

Dated:

C:\law-docs\foreign\FIRPTA\Cert\masters\Entity.doc

05/25/04

1

1