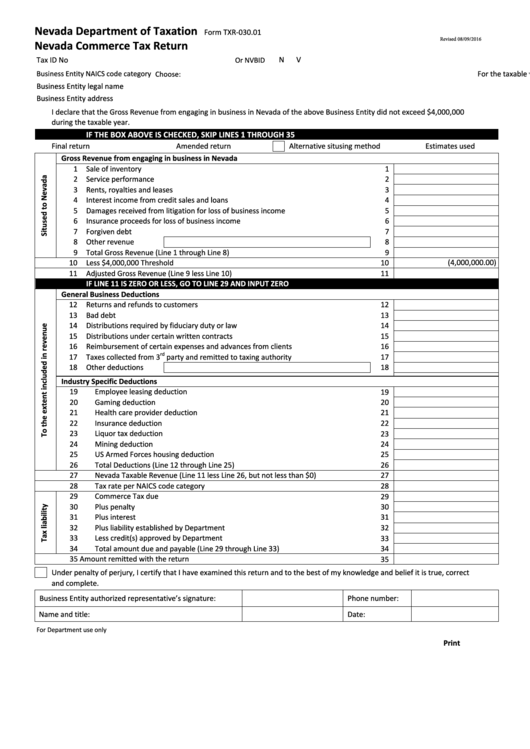

Nevada Department of Taxation

Form TXR-030.01

Revised 08/09/2016

Nevada Commerce Tax Return

N

V

Or NVBID

Tax ID No

Business Entity NAICS code category

Choose:

For the taxable year

through

Business Entity legal name

Business Entity address

I declare that the Gross Revenue from engaging in business in Nevada of the above Business Entity did not exceed $4,000,000

during the taxable year.

IF THE BOX ABOVE IS CHECKED, SKIP LINES 1 THROUGH 35

Final return

Amended return

Alternative situsing method

Estimates used

Gross Revenue from engaging in business in Nevada

1

Sale of inventory

1

2

Service performance

2

3

Rents, royalties and leases

3

4

Interest income from credit sales and loans

4

5

Damages received from litigation for loss of business income

5

6

Insurance proceeds for loss of business income

6

7

Forgiven debt

7

8

Other revenue

8

9

Total Gross Revenue (Line 1 through Line 8)

9

(4,000,000.00)

10

Less $4,000,000 Threshold

10

11

Adjusted Gross Revenue (Line 9 less Line 10)

11

IF LINE 11 IS ZERO OR LESS, GO TO LINE 29 AND INPUT ZERO

General Business Deductions

12

Returns and refunds to customers

12

13

Bad debt

13

14

Distributions required by fiduciary duty or law

14

15

Distributions under certain written contracts

15

16

Reimbursement of certain expenses and advances from clients

16

rd

17

Taxes collected from 3

party and remitted to taxing authority

17

18

Other deductions

18

Industry Specific Deductions

19

Employee leasing deduction

19

20

Gaming deduction

20

21

Health care provider deduction

21

22

Insurance deduction

22

23

Liquor tax deduction

23

24

Mining deduction

24

25

US Armed Forces housing deduction

25

26

Total Deductions (Line 12 through Line 25)

26

Nevada Taxable Revenue (Line 11 less Line 26, but not less than $0)

27

27

28

Tax rate per NAICS code category

28

29

Commerce Tax due

29

30

Plus penalty

30

31

Plus interest

31

32

Plus liability established by Department

32

33

Less credit(s) approved by Department

33

34

Total amount due and payable (Line 29 through Line 33)

34

35

Amount remitted with the return

35

Under penalty of perjury, I certify that I have examined this return and to the best of my knowledge and belief it is true, correct

and complete.

Business Entity authorized representative’s signature:

Phone number:

Name and title:

Date:

For Department use only

Print

1

1