Sales Tax Return Worksheet

ADVERTISEMENT

License Number

Return Period

Date Filed

Amount Paid

Department of

Check Number

R

evenue

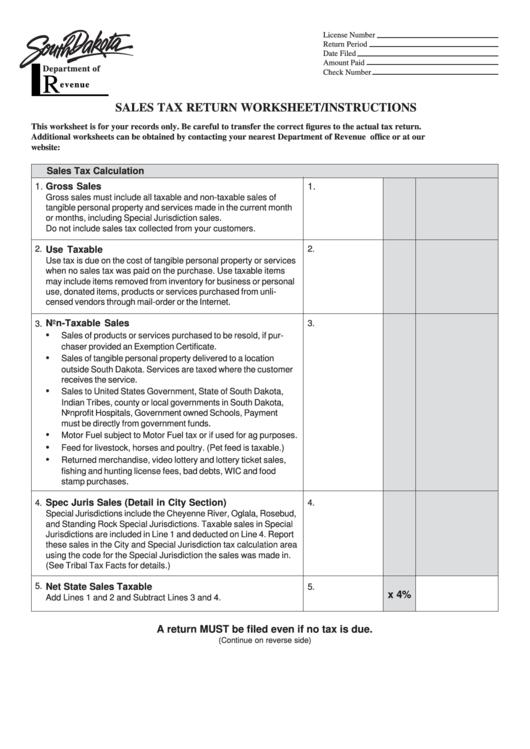

SALES TAX RETURN WORKSHEET/INSTRUCTIONS

This worksheet is for your records only. Be careful to transfer the correct figures to the actual tax return.

Additional worksheets can be obtained by contacting your nearest Department of Revenue office or at our

website:

Sales Tax Calculation

1.

Gross Sales

1.

Gross sales must include all taxable and non-taxable sales of

tangible personal property and services made in the current month

or months, including Special Jurisdiction sales.

Do not include sales tax collected from your customers.

2.

Use Taxable

2.

Use tax is due on the cost of tangible personal property or services

when no sales tax was paid on the purchase. Use taxable items

may include items removed from inventory for business or personal

use, donated items, products or services purchased from unli-

censed vendors through mail-order or the Internet.

Non-Taxable Sales

3.

3.

•

Sales of products or services purchased to be resold, if pur-

chaser provided an Exemption Certificate.

•

Sales of tangible personal property delivered to a location

outside South Dakota. Services are taxed where the customer

receives the service.

•

Sales to United States Government, State of South Dakota,

Indian Tribes, county or local governments in South Dakota,

Nonprofit Hospitals, Government owned Schools, Payment

must be directly from government funds.

•

Motor Fuel subject to Motor Fuel tax or if used for ag purposes.

•

Feed for livestock, horses and poultry. (Pet feed is taxable.)

•

Returned merchandise, video lottery and lottery ticket sales,

fishing and hunting license fees, bad debts, WIC and food

stamp purchases.

Spec Juris Sales (Detail in City Section)

4.

4.

Special Jurisdictions include the Cheyenne River, Oglala, Rosebud,

and Standing Rock Special Jurisdictions. Taxable sales in Special

Jurisdictions are included in Line 1 and deducted on Line 4. Report

these sales in the City and Special Jurisdiction tax calculation area

using the code for the Special Jurisdiction the sales was made in.

(See Tribal Tax Facts for details.)

5.

Net State Sales Taxable

5.

x 4%

Add Lines 1 and 2 and Subtract Lines 3 and 4.

A return MUST be filed even if no tax is due.

(Continue on reverse side)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2