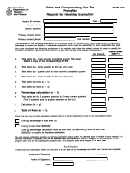

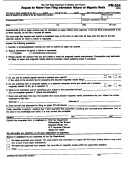

ONLY COMPLETE THIS PAGE IF YOU ANSWERED YES TO LINE (E) ON PAGE 1.

This agreement is made and entered into between and by the _______________________________________________

__________________________________________________ (name of political subdivision), hereinafter referred to as

Exempt Entity; and ___________________________________ (name of beneficiary of industrial revenue bond proceeds),

hereinafter referred to as Beneficiary.

It is hereby agreed by all parties to this agreement that the construction project for which the request for an exemption

certificate is being made would be exempt from sales tax solely due to the fact that it is being financed by industrial revenue

bonds. It shall be the duty of the Exempt Entity to notify the Kansas Department of Revenue when the industrial revenue

bonds have actually been issued.

Whereas, the Kansas Department of Revenue deems it necessary to ensure that sales or compensating tax is paid should

the project not be financed by industrial revenue bonds, it is hereby further agreed by the Beneficiary that if the industrial

revenue bonds have not been issued by the time the project is completed then the Beneficiary will remit to the Kansas

Department of Revenue the sales or compensating tax and applicable interest on tax which is due based upon the cost of

tangible personal property or services used or consumed in the construction of the project. It is agreed that the Secretary of

Revenue shall determine when the project has been completed.

The Director of Policy and Research shall have the right to demand from the Beneficiary payment of the sales and compensating

tax and applicable interest due the state should the Kansas Department of Revenue not receive such payment within thirty

(30) days after the project has been completed.

Any and all notices required herein shall be mailed and addressed as follows:

A. Notices to the Department of Revenue shall be addressed to: Director of Policy and Research, Kansas Department of

Revenue, 915 SW Harrison St., Room 230, Topeka, Kansas 66612-1588;

B. Notices to the Exempt Entity shall be addressed to: ____________________________________________________

____________________________________________________________________________________________

C. Notices to the Beneficiary shall be addressed to: ______________________________________________________

____________________________________________________________________________________________

This agreement shall be binding upon all parties hereto and any and all their successors.

IN WITNESS WHEREOF, the parties hereto have caused this instrument to be executed by persons authorized to do so

lawfully and with full corporate authority.

BENEFICIARY OF INDUSTRIAL REVENUE BOND

POLITICAL SUBDIVISION

PROCEEDS

____________________________________________

____________________________________________

Authorized Signature

Authorized Signature

____________________________________________

____________________________________________

Type or Print Name and Title

Type or Print Name and Title

DATED: _____________________________________

DATED: _____________________________________

1

1 2

2