Form Pr-70b - Request For Project Exemption Certificate - Kansas Department Of Revenue

ADVERTISEMENT

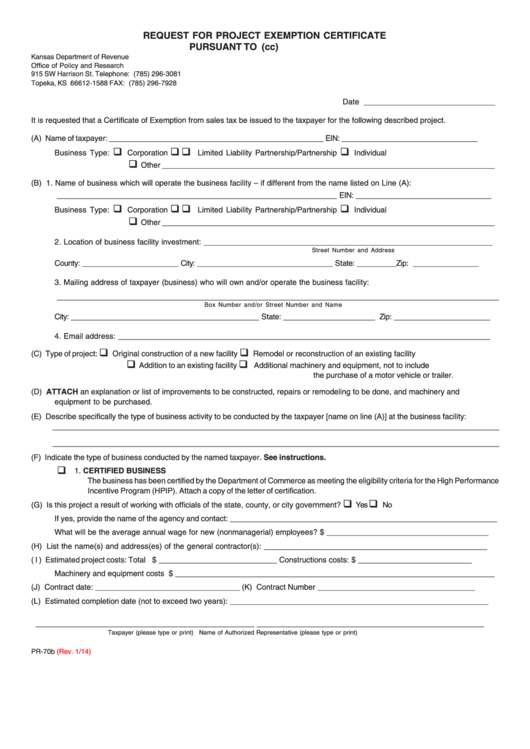

REQUEST FOR PROJECT EXEMPTION CERTIFICATE

PURSUANT TO K.S.A. 79-3606(cc)

Kansas Department of Revenue

Office of Policy and Research

915 SW Harrison St.

Telephone: (785) 296-3081

Topeka, KS 66612-1588

FAX: (785) 296-7928

Date ______________________________

It is requested that a Certificate of Exemption from sales tax be issued to the taxpayer for the following described project.

(A)

Name of taxpayer: _________________________________________________

EIN: _______________________________

‰

‰

‰

‰

Business Type:

Corporation

L.L.C

Limited Liability Partnership/Partnership

Individual

‰

Other ____________________________________________________________________________

(B)

1.

Name of business which will operate the business facility – if different from the name listed on Line (A):

________________________________________________________________

EIN: _______________________________

‰

‰

‰

‰

Business Type:

Corporation

L.L.C

Limited Liability Partnership/Partnership

Individual

‰

Other ____________________________________________________________________________

2.

Location of business facility investment: __________________________________________________________________

Street Number and Address

County: ______________________

City: _______________________________

State: _________ Zip: _______________

3.

Mailing address of taxpayer (business) who will own and/or operate the business facility:

_____________________________________________________________________________________________________

Box Number and/or Street Number and Name

City: ___________________________________________

State: _____________________ Zip: ______________________

4.

Email address: _____________________________________________________________________________________

‰

‰

(C)

Type of project:

Original construction of a new facility

Remodel or reconstruction of an existing facility

‰

‰

Addition to an existing facility

Additional machinery and equipment, not to include

the purchase of a motor vehicle or trailer.

(D)

ATTACH an explanation or list of improvements to be constructed, repairs or remodeling to be done, and machinery and

equipment to be purchased.

(E)

Describe specifically the type of business activity to be conducted by the taxpayer [name on line (A)] at the business facility:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

(F)

Indicate the type of business conducted by the named taxpayer. See instructions.

‰

1. CERTIFIED BUSINESS

The business has been certified by the Department of Commerce as meeting the eligibility criteria for the High Performance

Incentive Program (HPIP). Attach a copy of the letter of certification.

‰

‰

(G)

Is this project a result of working with officials of the state, county, or city government?

Yes

No

If yes, provide the name of the agency and contact: _____________________________________________________________

What will be the average annual wage for new (nonmanagerial) employees? $ _____________________________________

(H)

List the name(s) and address(es) of the general contractor(s): ___________________________________________________

( I )

Estimated project costs: Total $ ___________________________

Constructions costs: $ __________________________

Machinery and equipment costs $ _________________________________________________________________________

(J)

Contract date: _________________________________

(K) Contract Number ____________________________________

(L)

Estimated completion date (not to exceed two years): ___________________________________________________________

__________________________________________________

____________________________________________________

Taxpayer (please type or print)

Name of Authorized Representative (please type or print)

PR-70b

(Rev. 1/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1