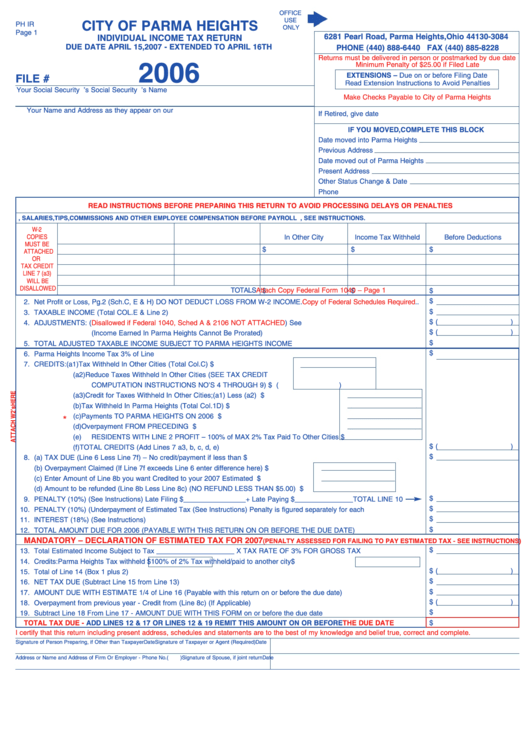

Individual Income Tax Return Form - City Of Parma Heights - 2006

ADVERTISEMENT

OFFICE

USE

CITY OF PARMA HEIGHTS

PH IR

ONLY

Page 1

6281 Pearl Road, Parma Heights, Ohio 44130-3084

INDIVIDUAL INCOME TAX RETURN

DUE DATE APRIL 15, 2007 - EXTENDED TO APRIL 16TH

PHONE (440) 888-6440 FAX (440) 885-8228

Returns must be delivered in person or postmarked by due date

2006

Minimum Penalty of $25.00 if Filed Late

EXTENSIONS – Due on or before Filing Date

FILE #

Read Extension Instructions to Avoid Penalties

Your Social Security No.

Spouse’s Social Security No.

Spouse’s Name

Make Checks Payable to City of Parma Heights

Your Name and Address as they appear on our records. Make any Necessary Corrections

If Retired, give date

IF YOU MOVED, COMPLETE THIS BLOCK

Date moved into Parma Heights

Previous Address

Date moved out of Parma Heights

Present Address

Other Status Change & Date

Phone No.

Daytime No.

READ INSTRUCTIONS BEFORE PREPARING THIS RETURN TO AVOID PROCESSING DELAYS OR PENALTIES

1. WAGES, SALARIES, TIPS, COMMISSIONS AND OTHER EMPLOYEE COMPENSATION BEFORE PAYROLL DEDUCTIONS. IF PARTIAL YEAR RESIDENT, SEE INSTRUCTIONS.

C. Tax Withheld

D. Parma Heights

E. Gross Earnings

W-2

A. Names of Employers

B. City Where Employed

COPIES

In Other City

Income Tax Withheld

Before Deductions

MUST BE

$

$

$

ATTACHED

OR

TAX CREDIT

LINE 7 (a3)

WILL BE

DISALLOWED

Attach Copy Federal Form 1040 – Page 1

TOTALS

$

$

$

$

2.

Net Profit or Loss, Pg. 2 (Sch. C, E & H) DO NOT DEDUCT LOSS FROM W-2 INCOME.

Copy of Federal Schedules Required

..

$

3.

TAXABLE INCOME (Total COL. E & Line 2) ....................................................................................................................................

$ (

)

4.

ADJUSTMENTS: A. Business Expense

(Disallowed if Federal 1040, Sched A & 2106 NOT

ATTACHED) See Instructions ......

$ (

)

B. Less Income Earned While Non-Resident (Income Earned In Parma Heights Cannot Be Prorated) ..........

$

5.

TOTAL ADJUSTED TAXABLE INCOME SUBJECT TO PARMA HEIGHTS INCOME TAX..............................................................

$

6.

Parma Heights Income Tax 3% of Line 5 ........................................................................................................................................

7.

CREDITS: (a1) Tax Withheld In Other Cities (Total Col. C) ......................................$

(a2) Reduce Taxes Withheld In Other Cities (SEE TAX CREDIT

COMPUTATION INSTRUCTIONS NO’S 4 THROUGH 9) ..............$ (

)

(a3) Credit for Taxes Withheld In Other Cities; (a1) Less (a2) ...................................... $

(b)

Tax Withheld In Parma Heights (Total Col. 1D)...................................................... $

(c)

Payments TO PARMA HEIGHTS ON 2006 ESTIMATE ........................................ $

*

(d)

Overpayment FROM PRECEDING YEAR ............................................................ $

(e)

RESIDENTS WITH LINE 2 PROFIT – 100% of MAX 2% Tax Paid To Other Cities $

$ (

)

(f)

TOTAL CREDITS (Add Lines 7 a3, b, c, d, e) ....................................................................................................

$

8.

(a) TAX DUE (Line 6 Less Line 7f) – No credit/payment if less than $1.00 ....................................................................................

(b) Overpayment Claimed (If Line 7f exceeds Line 6 enter difference here) ........................ $

(c) Enter Amount of Line 8b you want Credited to your 2007 Estimated Tax ........................ $

(d) Amount to be refunded (Line 8b Less Line 8c) (NO REFUND LESS THAN $5.00) ........ $

$

9.

PENALTY (10%) (See Instructions) Late Filing $________________ + Late Paying $_______________ TOTAL LINE 10

$

10.

PENALTY (10%) (Underpayment of Estimated Tax (See Instructions) Penalty is figured separately for each installment ............

$

11.

INTEREST (18%) (See Instructions)................................................................................................................................................

$

12.

TOTAL AMOUNT DUE FOR 2006 (PAYABLE WITH THIS RETURN ON OR BEFORE THE DUE DATE)......................................

MANDATORY – DECLARATION OF ESTIMATED TAX FOR 2007

(PENALTY ASSESSED FOR FAILING TO PAY ESTIMATED TAX - SEE INSTRUCTIONS)

$

13.

Total Estimated Income Subject to Tax ____________________ X TAX RATE OF 3% FOR GROSS TAX OF ............................

14.

Credits: Parma Heights Tax withheld $

100% of 2% Tax withheld/paid to another city $

$ (

)

15.

Total of Line 14 (Box 1 plus 2)..........................................................................................................................................................

$

16.

NET TAX DUE (Subtract Line 15 from Line 13) ..............................................................................................................................

$

17.

AMOUNT DUE WITH ESTIMATE 1/4 of Line 16 (Payable with this return on or before the due date) ..........................................

$ (

)

18.

Overpayment from previous year - Credit from (Line 8c) (If Applicable)..........................................................................................

$

19.

Subtract Line 18 From Line 17 - AMOUNT DUE WITH THIS FORM on or before the due date

....................................................

TOTAL TAX DUE -

ADD LINES 12 & 17 OR LINES 12 & 19 REMIT THIS AMOUNT ON OR BEFORE

THE DUE DATE

$

I certify that this return including present address, schedules and statements are to the best of my knowledge and belief true, correct and complete.

Signature of Person Preparing, if Other than Taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

Address or Name and Address of Firm Or Employer - Phone No. (

)

Signature of Spouse, if joint return

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2