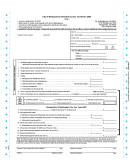

Individual Income Tax Return Form - City Of Parma Heights - 2006 Page 2

ADVERTISEMENT

Page 2

SCHEDULE C

PROFIT OR LOSS FROM BUSINESS OR PROFESSION

Business Name

Business Address

1. Net Profit or Loss ......................................................................................................................................................................................

$

2. Add Items not Deductible (Schedule X Line D) ........................................................................................................................................

3. Deduct Items not Taxable (Schedule X Line F)..........................................................................................................................................

(

)

4. Adjusted Net Profit or Loss ........................................................................................................................................................................

$

5. Schedule Y ________% allocable to Parma Heights (Parma Heights residents disregard)......................................................................

6. Less allocable net loss carry-forward 5 year limit (See Instructions) ........................................................................................................

7. Net Profit or Loss (NET PROFIT ONLY, Line 4 or Line 7 enter on Line 2, page 1) ..................................................................................

$

NOTE: A loss in one city may never offset the gain in another city. However, a SCH C business or SCH E Pg. 1 rental gain may be offset by a loss in the SAME

city (See Instructions)

SCHEDULE E

INCOME FROM RENTS (Not included in Schedule C)

Complete this Schedule if you are not required to file with the Internal Revenue Service. Otherwise, attach copy of Federal Schedules.

Eligible Loss

Net Income

Type & address of property, City & State

Amount of Rent

Depreciation

Repairs

Other Expenses

Carry Forward

or Loss

$

$

$

$

$

$

NOTE: LOSS Carry-Forward 5 year limit (See Instructions)

NET INCOME ONLY - Enter on Line 2, page 1

$

A loss in one city may never offset the gain in another city. However, a SCH C business or SCH E Pg. 1 rental gain may be offset by a loss in the SAME city (See Instructions)

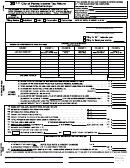

SCHEDULE H

ALL OTHER TAXABLE INCOME

Individual’s distributive share of income from pass-through entities, estates, trusts, director’s and other fees, farm and other sources (See Instructions)

(Lottery Winnings can be offset by Schedule “A” losses – must Attached Schedule A.)

Note: Income reported under Fed ID #’s are separate entities and CANNOT BE OFFSET

Received From

For (DESCRIBE)

Amount

$

TOTAL INCOME - Enter Line 2, page 1

$

SCHEDULE X

ADJUSTMENT OF NET PROFIT OR LOSS LINE 1, SCHEDULE C ABOVE

TO EXCLUDE INCOME NOT TAXABLE, AND EXPENSES NOT ALLOWABLE

Schedule X entries are allowed only to the extent directly included in determination of net profits as shown on your Federal Return.

ITEMS NOT DEDUCTIBLE - ADD

ITEMS NOT TAXABLE - DEDUCT

$

$

E.

A. Taxes based on Income ..................................................

B. Contributions & Donations ..............................................

C. Other (explain)

F. TOTAL DEDUCTIONS (enter Line 3, Schedule C) ........

D. TOTAL ADDITIONS (enter Line 2 Schedule C) ..............

$

$

a. LOCATED

b. LOCATED IN

PERCENTAGE

SCHEDULE Y BUSINESS APPORTIONMENT FORMULA

EVERYWHERE

PARMA HEIGHTS

(b ÷ a)

STEP 1. AVG. ORIGINAL COST OF REAL & TANG. PERSONAL PROPERTY

$

$

GROSS ANNUAL RENTALS PAID MULTIPLIED BY 8

$

$

TOTAL STEP 1

$

$

%

STEP 2. GROSS RECEIPTS FROM SALES MADE AND/OR WORK

OR SERVICES PERFORMED (SEE INSTRUCTIONS)

$

$

%

STEP 3. WAGES, SALARIES, AND OTHER COMPENSATION PAID

$

$

%

4. TOTAL PERCENTAGES

%

5. AVERAGE PERCENTAGE (Divide Total Percentages

by Number of Percentages Used)

%

Carry to Schedule C, Line 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2