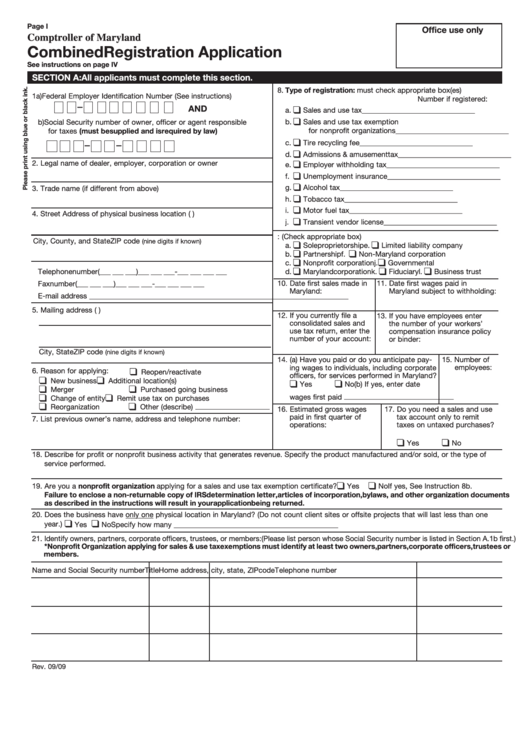

Page I

Office use only

Comptroller of Maryland

Combined Registration Application

See instructions on page IV

SECTION A: All applicants must complete this section.

8. Type of registration: must check appropriate box(es)

1a) Federal Employer Identification Number (See instructions)

Number if registered:

–

K

AND

a.

Sales and use tax

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

K

b.

Sales and use tax exemption

b) Social Security number of owner, officer or agent responsible

for nonprofit organizations

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

for taxes (must be supplied and is required by law)

K

c.

Tire recycling fee

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

–

–

K

d.

Admissions & amusement tax

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

K

2. Legal name of dealer, employer, corporation or owner

e.

Employer withholding tax

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

K

f.

Unemployment insurance

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

K

g.

Alcohol tax

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

3. Trade name (if different from above)

K

h.

Tobacco tax

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

K

i.

Motor fuel tax

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4. Street Address of physical business location (P.O. box not acceptable)

K

j.

Transient vendor license

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

9.Type of ownership: (Check appropriate box)

City, County, and State

ZIP code

(nine digits if known)

K

K

a.

Sole proprietorship

e.

Limited liability company

K

K

b.

Partnership

f.

Non-Maryland corporation

K

K

c.

Nonprofit corporation j.

Governmental

K

K

K

Telephone number

( _ _ _ _ _ _ _ _ _) _ _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ _ _ _ _

d.

Maryland corporation k.

Fiduciary l.

Business trust

Fax number

( _ _ _ _ _ _ _ _ _) _ _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ _ _ _ _

10. Date first sales made in

11. Date first wages paid in

Maryland:

Maryland subject to withholding:

E-mail address _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

5. Mailing address (P.O. box acceptable)

12. If you currently file a

13. If you have employees enter

consolidated sales and

the number of your workers’

use tax return, enter the

compensation insurance policy

number of your account:

or binder:

City, State

ZIP code

(nine digits if known)

14. (a) Have you paid or do you anticipate pay-

15. Number of

ing wages to individuals, including corporate

employees:

K

6. Reason for applying:

Reopen/reactivate

officers, for services performed in Maryland?

K

K

K

K

New business

Additional location(s)

Yes

No (b) If yes, enter date

K

K

Merger

Purchased going business

K

K

wages first paid _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Change of entity

Remit use tax on purchases

K

K

Reorganization

Other (describe)

16. Estimated gross wages

17. Do you need a sales and use

paid in first quarter of

tax account only to remit

7. List previous owner’s name, address and telephone number:

operations:

taxes on untaxed purchases?

K

K

Yes

No

18. Describe for profit or nonprofit business activity that generates revenue. Specify the product manufactured and/or sold, or the type of

service performed.

K

K

19. Are you a nonprofit organization applying for a sales and use tax exemption certificate?

Yes

No

If yes, See Instruction 8b.

Failure to enclose a non-returnable copy of IRS determination letter, articles of incorporation, bylaws, and other organization documents

as described in the instructions will result in your application being returned.

20. Does the business have only one physical location in Maryland? (Do not count client sites or offsite projects that will last less than one

K

K

year.)

Yes

No Specify how many _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

21. Identify owners, partners, corporate officers, trustees, or members: (Please list person whose Social Security number is listed in Section A.1b first.)

*Nonprofit Organization applying for sales & use tax exemptions must identify at least two owners, partners, corporate officers, trustees or

members.

Name and Social Security number

Title

Home address, city, state, ZIP code

Telephone number

Rev. 09/09

1

1 2

2