Page II - See instructions on page III

FEIN or SSN

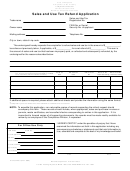

SECTION B: Complete this section to register for an unemployment insurance account.

PART 1.

2. Department Of Assessments & Taxation

3. Did you acquire by sale or otherwise, all or part

1. Will corporate officers receive compensation,

K

K

Entity Identification Number

of the assets, business, organization, or work-

salary or distribution of profits?

Yes

No

K

K

force of another employer?

Yes

No

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

If yes, enter date.

4. If your answer to question 3 is “No,” proceed to item 5 of this section. If your answer to question 3 is “Yes,” provide the information below.

K

K

a. Is there any common ownership, management or control between the current business and the former business?

Yes

No

b. Percentage of assets or workforce acquired from former business:

c. Date former business was acquired by current business:

d. Unemployment insurance number of former business, if known: 0 0 _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

e. Did the previous owner operate more than one location in Maryland?

5. For employers of domestic help only:

6. For agricultural operating only:

a) Have you or will you have as an individual or local

a) Have you had or will you have 10 or more workers for 20 weeks or more in

college club, college fraternity or sorority a total payroll

any calendar year or have you paid or will you pay $20,000 or more in

of $1,000 or more in the State of Maryland during any

wages during any calendar quarter?

K

K

calendar quarter?

Yes

No

K

K

Yes

No

b) If yes, indicate the earliest quarter and calendar year.

b) If yes, indicate the earliest quarter and calendar year.

PART 2. COMPLETE THIS PART IF YOU ARE A NONPROFIT ORGANIZATION.

1. Are you subject to tax under the Federal Unemployment Tax Act?

2. If not, are you exempt under Section 3306(c)(8) of the Federal

K Yes

K No

K Yes

K No

Unemployment Tax Act?

3. Are you a non-profit organization as described in Section 501(c)(3) of the United States Internal Revenue Code which is exempt from Income Tax

K Yes

K No

under Section 501(a) of such code? If YES, attach a copy of your exemption from Internal Revenue Service.

4. Elect option to finance unemployment insurance coverage. See instructions.

a. K Contributions

b. K Reimbursement of trust fund

If b. is checked, indicate the total taxable payroll ($8,500 maximum per individual per calendar year) $

for calendar year 20

K Letter of credit

K Surety bond

K Security deposit

K Cash in escrow

Type of collateral (check one)

SECTION C: Complete this section if you are applying for an alcohol or tobacco tax license.

1. Will you engage in any business activity pertaining to the manufacture,

2. Will you engage in any wholesale activity regarding the sale and/or

sale, distribution, or storage of alcoholic beverages (excludes retail)?

distribution of cigarettes in Maryland (excludes retail)?

K Yes

K No

K Yes

K No

SECTION D: Complete this section if you plan to sell, use or transport any fuels in Maryland

1. Do you plan to import or purchase in Maryland,

2. Do you transport petroleum in any device

3. Do you store any motor fuel in Maryland?

K Yes

K No

any of the following fuels for resale, distribution,

having a carrying capacity exceeding 1,749

or for your use?

gallons?

K Yes

K No

K Yes

K No

If yes, check type below:

4. Do you have a commercial vehicle that will travel interstate?

K Gasoline (including av/gas)

K Yes

K No

K Turbine/jet fuel

K Special fuel (any fuel other than gasoline)

If you have answered yes to any question in Section C or D, call the Motor-fuel, Alcohol and Tobacco Tax Unit 410-260-7131 for the license

application.

SECTION E: All applicants must complete this section.

I DECLARE UNDER THE PENALTY OF PERJURY THAT THIS APPLICATION HAS BEEN EXAMINED BY ME AND TO

THE BEST OF MY KNOWLEDGE AND BELIEF IS TRUE, CORRECT, AND COMPLETE.

SIGN

®

Date

Print Name

Title

HERE

Name of Preparer

other than

Phone

E-mail

applicant

number

address

If the business is a corporation, an officer of the corporation authorized to sign on behalf of the corporation

must sign; if a partnership, one partner must sign; if an unincorporated association, one member must sign; if a

sole proprietorship, the proprietor must sign. (The signature of any other person will not be accepted.)

1

1 2

2