Indiana S Corporation Income Tax Return Form 2007

ADVERTISEMENT

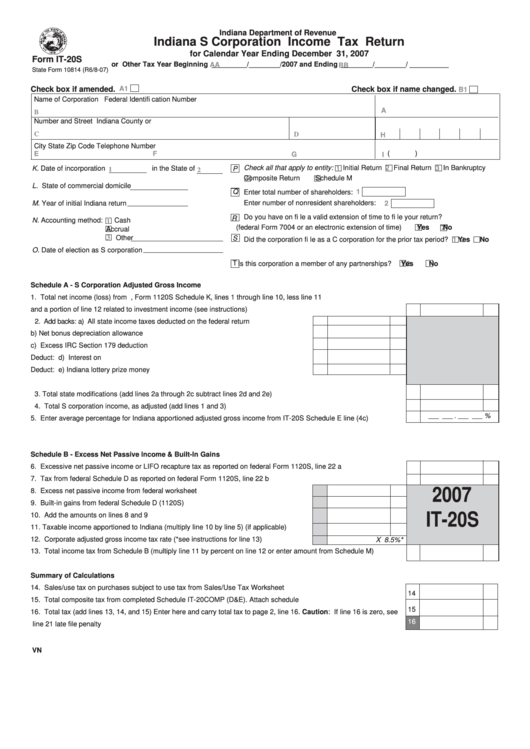

Indiana Department of Revenue

Indiana S Corporation Income Tax Return

for Calendar Year Ending December 31, 2007

Form IT-20S

or Other Tax Year Beginning _________/________/2007 and Ending ________/________/ __________

AA

BB

State Form 10814 (R6/8-07)

A1

Check box if amended.

Check box if name changed.

B1

Name of Corporation

Federal Identifi cation Number

A

B

Number and Street

Indiana County or O.O.S.

Principal Business Activity Code

C

D

H

City

State

Zip Code

Telephone Number

(

)

E

F

G

I

Check all that apply to entity:

1

Initial Return

2

Final Return

3

In Bankruptcy

K. Date of incorporation

in the State of

P

1

2

4

Composite Return

5

Schedule M

L. State of commercial domicile

1

Q

Enter total number of shareholders:

Enter number of nonresident shareholders:

M. Year of initial Indiana return

2

Do you have on fi le a valid extension of time to fi le your return?

R

N. Accounting method:

Cash

1

(federal Form 7004 or an electronic extension of time)

1

Yes

2

No

2

Accrual

3

Other

S

Did the corporation fi le as a C corporation for the prior tax period?

1

Yes

2

No

O. Date of election as S corporation

T

Is this corporation a member of any partnerships?

1

Yes

2

No

Schedule A - S Corporation Adjusted Gross Income

1. Total net income (loss) from U.S. S corporation return, Form 1120S Schedule K, lines 1 through line 10, less line 11

and a portion of line 12 related to investment income (see instructions) .........................................................................

1

2. Add backs: a) All state income taxes deducted on the federal return .............................

2a

b) Net bonus depreciation allowance ..........................................................

2b

c) Excess IRC Section 179 deduction ..........................................................

2c

Deduct:

d) Interest on U.S. Government obligations ...............................................

2d

Deduct:

e) Indiana lottery prize money ......................................................................

2e

3. Total state modifi cations (add lines 2a through 2c subtract lines 2d and 2e) ...................................................................

3

4. Total S corporation income, as adjusted (add lines 1 and 3) ...........................................................................................

4

___ ___ . ___ ___ %

5. Enter average percentage for Indiana apportioned adjusted gross income from IT-20S Schedule E line (4c) ...............

5

Schedule B - Excess Net Passive Income & Built-In Gains

6. Excessive net passive income or LIFO recapture tax as reported on federal Form 1120S, line 22 a ............................

6

7. Tax from federal Schedule D as reported on federal Form 1120S, line 22 b ...................................................................

7

2007

8. Excess net passive income from federal worksheet ......................................................

8

9. Built-in gains from federal Schedule D (1120S) ..............................................................

9

IT-20S

10. Add the amounts on lines 8 and 9 ..................................................................................

10

11. Taxable income apportioned to Indiana (multiply line 10 by line 5) (if applicable) ...........

11

12. Corporate adjusted gross income tax rate (*see instructions for line 13) ........................

12

X 8.5%*

13. Total income tax from Schedule B (multiply line 11 by percent on line 12 or enter amount from Schedule M) ................ 13

Summary of Calculations

14. Sales/use tax on purchases subject to use tax from Sales/Use Tax Worksheet ............................................................

14

15. Total composite tax from completed Schedule IT-20COMP (D&E). Attach schedule ......................................................

15

16. Total tax (add lines 13, 14, and 15) Enter here and carry total tax to page 2, line 16. Caution: If line 16 is zero, see

16

line 21 late fi le penalty ......................................................................................................................................................

VN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3