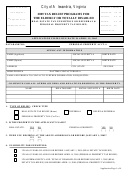

NET COMBINED FINANCIAL WORTH (ASSETS) SECTION AS OF 12/31/06

(NOT INCLUDING PRINCIPLE RESIDENCE AND LOT UP TO TWO ACRES)

List of Assets

Applicant

Spouse

Relative1

Relative2

1 Cash on hand

2 Checking accounts

3 Savings accounts and money market funds

4 Savings certificates (CDs)

5 IRA, 401K or other retirement accounts

6 Stocks, bonds and/or mutual funds

7 Life insurance (cash value only)

8 Annuity (cash value only)

9 Other real estate owned (2006 assessed value)

2006 assessed value of qualified

10

Automobile(s)

vehicle

2006 assessed value of other

value

vehicle(s)

$0

$0

$0

$0

Total All Assets

$0

Add Total Assets for each column to arrive at Net Combined Worth:

Are you required to file or did you file a Federal Income Tax Return for 2006?

YES

NO

RESET FORM TO ERASE ALL DATA

CLICK TO PRINT FORM

PLEASE NOTE :

•

Please attach a photocopy of your 2006 Federal Income Tax Return to this application if you are required to

file. If it is not available when you file this affidavit, it must be submitted by April 20, 2007.

•

All applicants must also attach photocopies of supporting documents that will verify all sources of income. i.e.,

Social Security (SSA-1099), Railroad Retirement (RRB-1099), Pension (1099-R), W-2, interest income (1099-

INT), dividend income (1099-DIV), miscellaneous income (1099-MISC), etc.

•

Failure to submit all financial documentation by the due date will result in the denial of your application.

DECLARATION

I declare under the penalties provided by law that this affidavit, financial statement and any accompanying schedules,

have been examined by me and to the best of my knowledge and belief are true, correct, and complete. (Any person or

persons falsely claiming an exemption shall be guilty of a misdemeanor).

ANY PERSON SIGNING FOR AN APPLICANT

UNABLE TO SIGN FOR HIMSELF/HERSELF, MUST SIGN THE APPLICANT’S NAME AND PROVIDE THE NAME,

ADDRESS, AND TELEPHONE NUMBER OF THE PERSON ASSISTING THE APPLICANT (Signee)*

_______________________

______________

________________________________

___________

Your Signature

Date

Spouse’s Signature

Date

_______________________

______________

____________________________________

________________

(Signee Name)*

Date

Address

Telephone #

Page 3 of 4

1

1 2

2 3

3 4

4