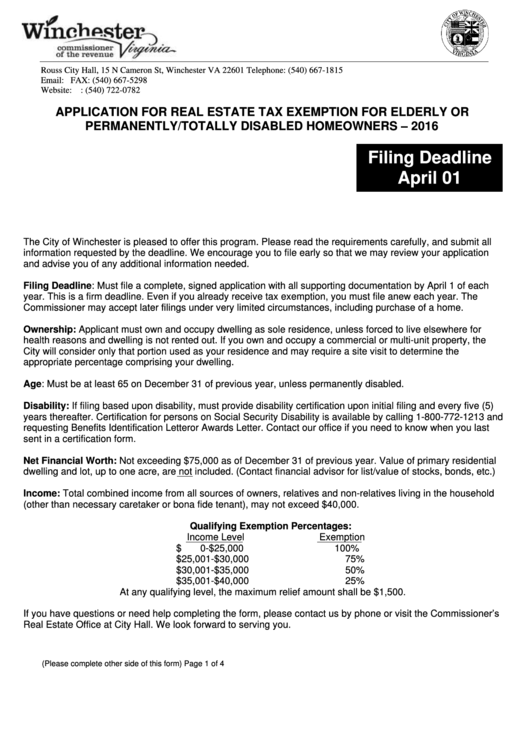

Application For Real Estate Tax Exemption For Elderly Or Permanently/totally Disabled Homeowners Form

ADVERTISEMENT

Rouss City Hall, 15 N Cameron St, Winchester VA 22601

Telephone:

(540) 667-1815

Email: commrevenue@winchesterva.gov

FAX:

(540) 667-5298

Website:

TDD:

(540) 722-0782

APPLICATION FOR REAL ESTATE TAX EXEMPTION FOR ELDERLY OR

PERMANENTLY/TOTALLY DISABLED HOMEOWNERS – 2016

Filing Deadline

April 01

The City of Winchester is pleased to offer this program. Please read the requirements carefully, and submit all

information requested by the deadline. We encourage you to file early so that we may review your application

and advise you of any additional information needed.

Filing Deadline: Must file a complete, signed application with all supporting documentation by April 1 of each

year. This is a firm deadline. Even if you already receive tax exemption, you must file anew each year. The

Commissioner may accept later filings under very limited circumstances, including purchase of a home.

Ownership: Applicant must own and occupy dwelling as sole residence, unless forced to live elsewhere for

health reasons and dwelling is not rented out. If you own and occupy a commercial or multi-unit property, the

City will consider only that portion used as your residence and may require a site visit to determine the

appropriate percentage comprising your dwelling.

Age: Must be at least 65 on December 31 of previous year, unless permanently disabled.

Disability: If filing based upon disability, must provide disability certification upon initial filing and every five (5)

years thereafter. Certification for persons on Social Security Disability is available by calling 1-800-772-1213 and

requesting Benefits Identification Letter or Awards Letter. Contact our office if you need to know when you last

sent in a certification form.

Net Financial Worth: Not exceeding $75,000 as of December 31 of previous year. Value of primary residential

dwelling and lot, up to one acre, are not included. (Contact financial advisor for list/value of stocks, bonds, etc.)

Income: Total combined income from all sources of owners, relatives and non-relatives living in the household

(other than necessary caretaker or bona fide tenant), may not exceed $40,000.

Qualifying Exemption Percentages:

Income Level

Exemption

$

0-$25,000

100%

$25,001-$30,000

75%

$30,001-$35,000

50%

$35,001-$40,000

25%

At any qualifying level, the maximum relief amount shall be $1,500.

If you have questions or need help completing the form, please contact us by phone or visit the Commissioner’s

Real Estate Office at City Hall. We look forward to serving you.

(Please complete other side of this form)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4