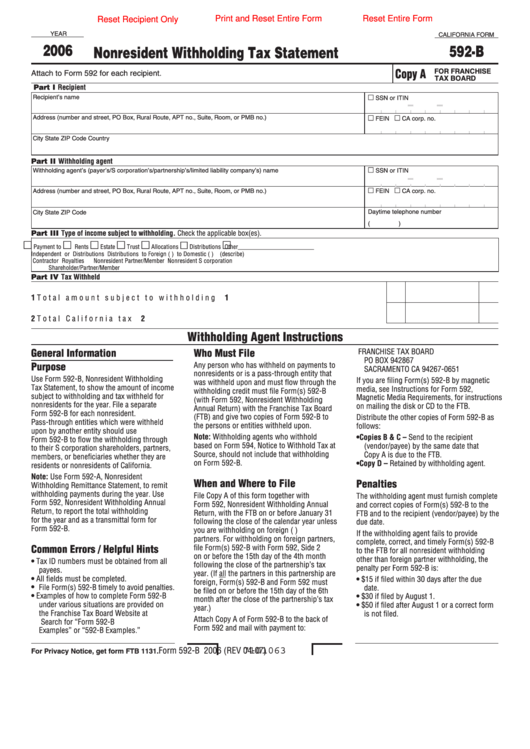

Reset Recipient Only

Print and Reset Entire Form

Reset Entire Form

YEAR

CALIFORNIA FORM

2006

592-B

Nonresident Withholding Tax Statement

Copy A

FOR FRANCHISE

Attach to Form 592 for each recipient.

TAX BOARD

Part I

Recipient

Recipient’s name

SSN or ITIN

Address (number and street, PO Box, Rural Route, APT no., Suite, Room, or PMB no.)

FEIN

CA corp. no.

City

State

ZIP Code

Country

Part II Withholding agent

Withholding agent’s (payer’s/S corporation’s/partnership’s/limited liability company’s) name

SSN or ITIN

Address (number and street, PO Box, Rural Route, APT no., Suite, Room, or PMB no.)

FEIN

CA corp. no.

Daytime telephone number

City

State

ZIP Code

(

)

Part III Type of income subject to withholding. Check the applicable box(es).

Payment to

Rents

Estate

Trust

Allocations

Distributions

Other_________________________

Independent

or

Distributions

Distributions

to Foreign (non-U.S.)

to Domestic (U.S.)

(describe)

Contractor

Royalties

Nonresident Partner/Member

Nonresident S corporation

Shareholder/Partner/Member

Part IV Tax Withheld

1 Total amount subject to withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Total California tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Withholding Agent Instructions

General Information

Who Must File

FRANCHISE TAX BOARD

PO BOX 942867

Purpose

Any person who has withheld on payments to

SACRAMENTO CA 94267-0651

nonresidents or is a pass-through entity that

Use Form 592-B, Nonresident Withholding

If you are filing Form(s) 592-B by magnetic

was withheld upon and must flow through the

Tax Statement, to show the amount of income

media, see Instructions for Form 592,

withholding credit must file Form(s) 592-B

subject to withholding and tax withheld for

Magnetic Media Requirements, for instructions

(with Form 592, Nonresident Withholding

nonresidents for the year. File a separate

on mailing the disk or CD to the FTB.

Annual Return) with the Franchise Tax Board

Form 592-B for each nonresident.

(FTB) and give two copies of Form 592-B to

Distribute the other copies of Form 592-B as

Pass-through entities which were withheld

the persons or entities withheld upon.

follows:

upon by another entity should use

Note: Withholding agents who withhold

• Copies B & C – Send to the recipient

Form 592-B to flow the withholding through

based on Form 594, Notice to Withhold Tax at

(vendor/payee) by the same date that

to their S corporation shareholders, partners,

Source, should not include that withholding

Copy A is due to the FTB.

members, or beneficiaries whether they are

on Form 592-B.

• Copy D – Retained by withholding agent.

residents or nonresidents of California.

Note: Use Form 592-A, Nonresident

When and Where to File

Penalties

Withholding Remittance Statement, to remit

withholding payments during the year. Use

File Copy A of this form together with

The withholding agent must furnish complete

Form 592, Nonresident Withholding Annual

Form 592, Nonresident Withholding Annual

and correct copies of Form(s) 592-B to the

Return, to report the total withholding

Return, with the FTB on or before January 31

FTB and to the recipient (vendor/payee) by the

for the year and as a transmittal form for

following the close of the calendar year unless

due date.

Form 592-B.

you are withholding on foreign (non-U.S.)

If the withholding agent fails to provide

partners. For withholding on foreign partners,

complete, correct, and timely Form(s) 592-B

Common Errors / Helpful Hints

file Form(s) 592-B with Form 592, Side 2

to the FTB for all nonresident withholding

on or before the 15th day of the 4th month

other than foreign partner withholding, the

• Tax ID numbers must be obtained from all

following the close of the partnership’s tax

penalty per Form 592-B is:

payees.

year. (If all the partners in this partnership are

• All fields must be completed.

• $15 if filed within 30 days after the due

foreign, Form(s) 592-B and Form 592 must

• File Form(s) 592-B timely to avoid penalties.

date.

be filed on or before the 15th day of the 6th

• Examples of how to complete Form 592-B

• $30 if filed by August 1.

month after the close of the partnership’s tax

under various situations are provided on

• $50 if filed after August 1 or a correct form

year.)

the Franchise Tax Board Website at

is not filed.

Attach Copy A of Form 592-B to the back of

Search for “Form 592-B

Form 592 and mail with payment to:

Examples” or “592-B Examples.”

7101063

Form 592-B 2006 (REV 04-07)

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3 4

4