Form 592-B - Nonresident Withholding Tax Statement - 2001

ADVERTISEMENT

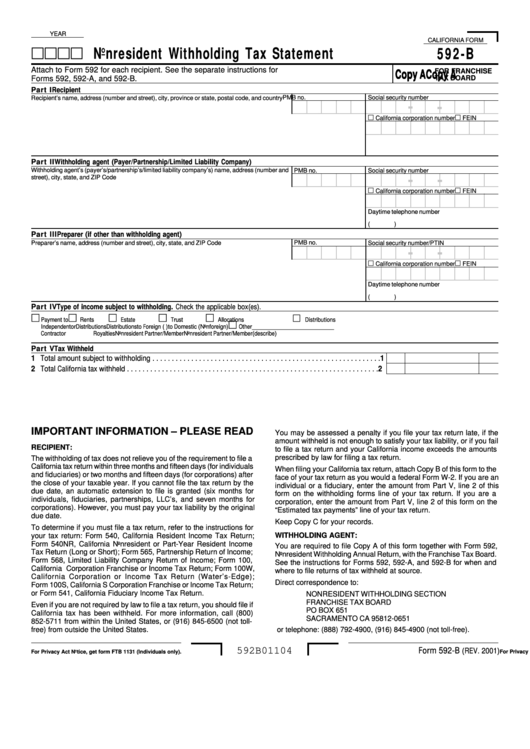

YEAR

CALIFORNIA FORM

Nonresident Withholding Tax Statement

592-B

Attach to Form 592 for each recipient. See the separate instructions for

FOR FRANCHISE

Copy A

Copy A

Copy A

Copy A

Copy A

Forms 592, 592-A, and 592-B.

TAX BOARD

Recipient

Part I

PMB no.

Social security number

Recipient’s name, address (number and street), city, province or state, postal code, and country

-

-

California corporation number

FEIN

Part II Withholding agent (Payer/Partnership/Limited Liability Company)

Withholding agent’s (payer’s/partnership’s/limited liability company’s) name, address (number and

PMB no.

Social security number

-

-

street), city, state, and ZIP Code

California corporation number

FEIN

Daytime telephone number

(

)

Part III Preparer (if other than withholding agent)

Preparer’s name, address (number and street), city, state, and ZIP Code

PMB no.

Social security number/PTIN

-

-

California corporation number

FEIN

Daytime telephone number

(

)

Part IV Type of income subject to withholding. Check the applicable box(es).

Payment to

Rents

Estate

Trust

Allocations

Distributions

Independent

or

Distributions

Distributions

to Foreign (non-U.S.)

to Domestic (Nonforeign)

Other___________________________

Contractor

Royalties

Nonresident Partner/Member

Nonresident Partner/Member

(describe)

Tax Withheld

Part V

1 Total amount subject to withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Total California tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

IMPORTANT INFORMATION – PLEASE READ

You may be assessed a penalty if you file your tax return late, if the

amount withheld is not enough to satisfy your tax liability, or if you fail

RECIPIENT:

to file a tax return and your California income exceeds the amounts

prescribed by law for filing a tax return.

The withholding of tax does not relieve you of the requirement to file a

California tax return within three months and fifteen days (for individuals

When filing your California tax return, attach Copy B of this form to the

and fiduciaries) or two months and fifteen days (for corporations) after

face of your tax return as you would a federal Form W-2. If you are an

the close of your taxable year. If you cannot file the tax return by the

individual or a fiduciary, enter the amount from Part V, line 2 of this

due date, an automatic extension to file is granted (six months for

form on the withholding forms line of your tax return. If you are a

individuals, fiduciaries, partnerships, LLC’s, and seven months for

corporation, enter the amount from Part V, line 2 of this form on the

corporations). However, you must pay your tax liability by the original

“Estimated tax payments” line of your tax return.

due date.

Keep Copy C for your records.

To determine if you must file a tax return, refer to the instructions for

WITHHOLDING AGENT:

your tax return: Form 540, California Resident Income Tax Return;

Form 540NR, California Nonresident or Part-Year Resident Income

You are required to file Copy A of this form together with Form 592,

Tax Return (Long or Short); Form 565, Partnership Return of Income;

Nonresident Withholding Annual Return, with the Franchise Tax Board.

Form 568, Limited Liability Company Return of Income; Form 100,

See the instructions for Forms 592, 592-A, and 592-B for when and

California Corporation Franchise or Income Tax Return; Form 100W,

where to file returns of tax withheld at source.

California Corporation or Income Tax Return (Water’s-Edge);

Direct correspondence to:

Form 100S, California S Corporation Franchise or Income Tax Return;

or Form 541, California Fiduciary Income Tax Return.

NONRESIDENT WITHHOLDING SECTION

FRANCHISE TAX BOARD

Even if you are not required by law to file a tax return, you should file if

PO BOX 651

California tax has been withheld. For more information, call (800)

SACRAMENTO CA 95812-0651

852-5711 from within the United States, or (916) 845-6500 (not toll-

free) from outside the United States.

or telephone: (888) 792-4900, (916) 845-4900 (not toll-free).

592B01104

Form 592-B

(REV. 2001)

For Privacy Act Notice, get form FTB 1131 (Individuals only).

For Privacy Act Notice, get form FTB 1131 (Individuals only).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4