Form Hp 1040 - Individual Income Tax Return - City Of Highland Park - 2005 Page 4

ADVERTISEMENT

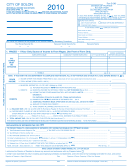

HP 1040

RESIDENT FROM ___________________ TO ____________________

SOCIAL SECURITY NO. _______________________________

SCHEDULE 4

DATE

DATE

ATTACH THIS SCHEDULE TO YOUR HP 1040

All income while

Portion of income

COMPLETE THIS SCHEDULE ONLY IF YOU HAD INCOME

a Highland Park

earned in

SUBJECT TO THE TAX BOTH AS A RESIDENT AND NON-

Resident

Highland Park while a

RESIDENT.

Non-Resident

1

2

$

A.

GROSS WAGES (Attach W-2 or HPW-2 to front of HP 1040)

$

A.

B.

NON-TAXABLE

B.

DIVIDENDS (from Federal Tax Return)

C. INTEREST, ROYALTIES, INCOME FROM TRUSTS AND ESTATES

C.

NON-TAXABLE

D.

INCOME (OR LOSS) FROM RENTS (write location of property below)

D.

E.

NET INCOME (OR LOSS) FROM PARTNERSHIPS, BUSINESS OR

PROFESSION. Small Business Corporation, Federal form 1120S, are

not permitted to file as so-called “tax-option” corporations. Every

corporation subject to city income tax must file a return and pay the tax.

Write name of business below:

E.

F.

GAIN (OR LOSS) FROM SALE OF PROPERTY (write the location of

of property below):

F.

G.

G. OTHER - EXPLAIN

H.

H. TOTAL INCOME - BOTH COLUMNS (Add lines A through G)

I.

LESS EXEMPTIONS - FORMULA

EXEMPTIONS X 600 X % OF TIME SPENT IN HIGHLAND PARK

I.

$

$

J.

J.

TAXABLE INCOME - Line H less line I (see instructions)

$

K.

K.

TAX - RESIDENT INCOME: Multiply line J, Column 1 by 2% (.02)

$

L.

L.

TAX - NON-RESIDENT: Multiply line J, Column 2 by 1% (.01)

M.

$

M. TOTAL TAX - Add lines K and L and enter on Page 1, line 8, HP 1040

INSTRUCTIONS FOR SCHEDULE 4

WHO MUST USE THIS SCHEDULE

LINE H - TOTAL INCOME: Add lines A-G for both columns.

You must complete schedule 4 if you earned part of your income

LINE I - EXEMPTIONS: Multiply your exemptions by $600, and

while a resident, and you earned income subject to Highland

by % of time spent in Highland Park, and enter in column 1. If col-

Park while a non-resident.

umn 1, Line 1 (exemption deduction) is larger than Line H (total

income) carry all of the excess to Column 2.

If you earned income as a resident but earned no Highland Park

income while a non-resident, do not use Schedule 4; check the

LINE J - TAXABLE INCOME: Subtract Line I from Line H and

Resident Box on Page 1, HP 1040, and file as a resident, using

enter on Line J. If Column 1 shows taxable income, it may be

the resident instructions. However, include only earnings and

reduced by a loss (on city income) in column 2. If Column 1 is 0,

income earned while a resident.

Column 2 cannot be less than 0.

ATTACH THIS SCHEDULE TO YOUR HP 1040

LINE K - TAX-RESIDENT INCOME: Multiply the taxable income

in Column 1, Line J by 2% (.02) and enter on this line.

LINES A TO G - INCOME AND SUBTRACTIONS

LINE L - TAX-NON-RESIDENT INCOME: Multiply the taxable

COLUMN 1 - Include the income items as though you were filing

income in Column 2, Line J by 1% (.01) and enter on this line.

as a resident but only that portion that was earned while a resi-

dent (see resident instructions) Formula = Exemptions x $600 x

LINE M - Add Lines K and L, enter here and on Page 1, line 8,

percentage of time a resident in Highland Park.

HP 1040.

COLUMN 2 - Include the income items as though you were filing

as a non-resident but only that portion that was earned in city

while a non-resident. Formula = Exemptions x $600 x percentage

of time a non-resident.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4