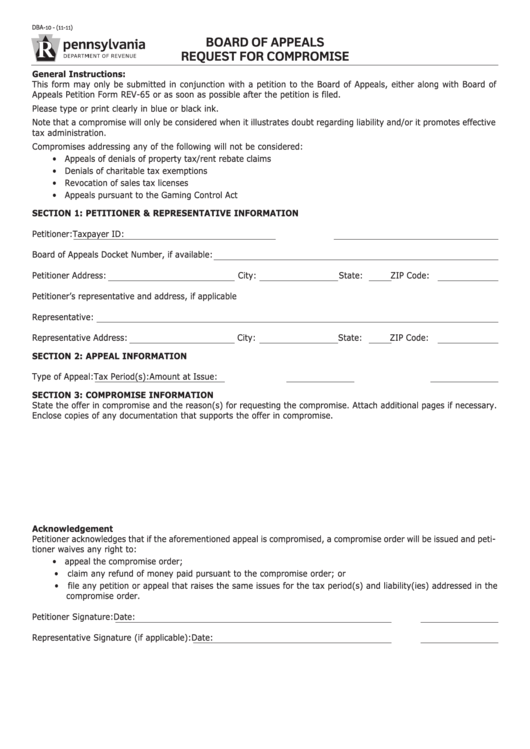

Form Dba-10 - Board Of Appeals - Request For Compromise

ADVERTISEMENT

DBA-10 - (11-11)

BOARD OF APPEALS

REQUEST FOR COMPROMISE

General Instructions:

This form may only be submitted in conjunction with a petition to the Board of Appeals, either along with Board of

Appeals Petition Form REV-65 or as soon as possible after the petition is filed.

Please type or print clearly in blue or black ink.

Note that a compromise will only be considered when it illustrates doubt regarding liability and/or it promotes effective

tax administration.

Compromises addressing any of the following will not be considered:

•

Appeals of denials of property tax/rent rebate claims

•

Denials of charitable tax exemptions

•

Revocation of sales tax licenses

•

Appeals pursuant to the Gaming Control Act

SECTION 1: PETITIONER & REPRESENTATIVE INFORMATION

Petitioner:

Taxpayer ID:

Board of Appeals Docket Number, if available:

Petitioner Address:

City:

State:

ZIP Code:

Petitioner’s representative and address, if applicable

Representative:

Representative Address:

City:

State:

ZIP Code:

SECTION 2: APPEAL INFORMATION

Type of Appeal:

Tax Period(s):

Amount at Issue:

SECTION 3: COMPROMISE INFORMATION

State the offer in compromise and the reason(s) for requesting the compromise. Attach additional pages if necessary.

Enclose copies of any documentation that supports the offer in compromise.

Acknowledgement

Petitioner acknowledges that if the aforementioned appeal is compromised, a compromise order will be issued and peti-

tioner waives any right to:

•

appeal the compromise order;

•

claim any refund of money paid pursuant to the compromise order; or

•

file any petition or appeal that raises the same issues for the tax period(s) and liability(ies) addressed in the

compromise order.

Petitioner Signature:

Date:

Representative Signature (if applicable):

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1