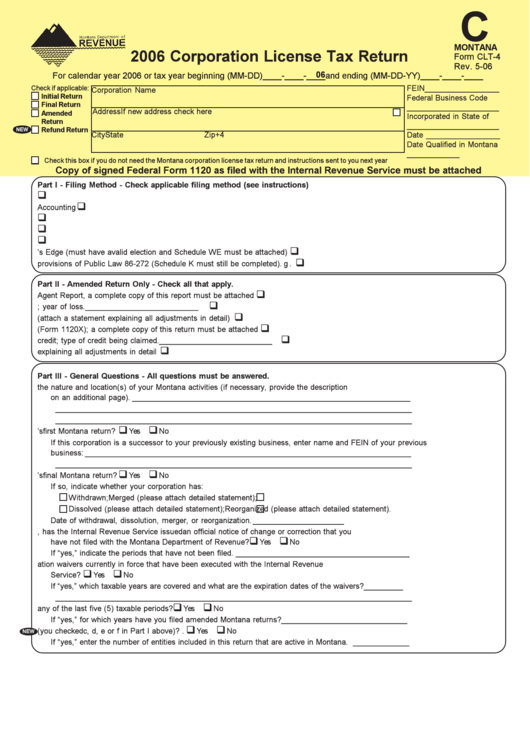

C

MONTANA

2006 Corporation License Tax Return

Form CLT-4

Rev. 5-06

06

For calendar year 2006 or tax year beginning (MM-DD)____-____-____and ending (MM-DD-YY)____-____-____

Check if applicable:

FEIN_________________

Corporation Name

Initial Return

Federal Business Code

Final Return

_____________________

Address

If new address check here

Amended

Incorporated in State of

Return

_____________________

Refund Return

NEW

City

State

Zip+4

Date _________________

Date Qualified in Montana

____________

Check this box if you do not need the Montana corporation license tax return and instructions sent to you next year

Copy of signed Federal Form 1120 as filed with the Internal Revenue Service must be attached

Part I - Filing Method - Check applicable filing method (see instructions)

a. Separate Company ........................................................................................................................................................... a.

b. Separate Accounting ......................................................................................................................................................... b.

c. Worldwide Combination ................................................................................................................................................... c.

d. Domestic Combination ..................................................................................................................................................... d.

e. Limited Combination ........................................................................................................................................................ e.

f.

Water’s Edge (must have a valid election and Schedule WE must be attached) ............................................................ f.

g. Exempt from tax under provisions of Public Law 86-272 (Schedule K must still be completed) .................................... g.

Part II - Amended Return Only - Check all that apply.

a. Federal Revenue Agent Report, a complete copy of this report must be attached ......................................................... a.

b. NOL carryback/carryforward; year of loss. __________________________

.............................................................. b.

c. Apportionment factor changes (attach a statement explaining all adjustments in detail) ............................................... c.

d. Amended federal return (Form 1120X); a complete copy of this return must be attached ............................................. d.

e. Application and/or change in tax credit; type of credit being claimed. __________________________

................... e.

f.

Other - Attach a statement explaining all adjustments in detail ........................................................................................ f.

Part III - General Questions - All questions must be answered.

a. Describe in detail the nature and location(s) of your Montana activities (if necessary, provide the description

on an additional page). ________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

b. Is this your corporation’s first Montana return? ......................................................................................................

Yes

No

If this corporation is a successor to your previously existing business, enter name and FEIN of your previous

business: ___________________________________________________________________________

__________________________________________________________________________________

c. Is this your corporation’s final Montana return? ......................................................................................................

Yes

No

If so, indicate whether your corporation has:

Withdrawn;

Merged (please attach detailed statement);

Dissolved (please attach detailed statement);

Reorganized (please attach detailed statement).

Date of withdrawal, dissolution, merger, or reorganization. _____________________

d. For any periods, has the Internal Revenue Service issued an official notice of change or correction that you

have not filed with the Montana Department of Revenue? .....................................................................................

Yes

No

If “yes,” indicate the periods that have not been filed. ________________________________________

e. Are any statute of limitation waivers currently in force that have been executed with the Internal Revenue

Service? ...................................................................................................................................................................

Yes

No

If “yes,” which taxable years are covered and what are the expiration dates of the waivers? _________

__________________________________________________________________________________

f.

Have you filed an amended federal return for any of the last five (5) taxable periods? .........................................

Yes

No

If “yes,” for which years have you filed amended Montana returns? _____________________________

g. Are you filing a combined Montana return (you checked c, d, e or f in Part I above)? ..........................................

Yes

No

NEW

If “yes,” enter the number of entities included in this return that are active in Montana. _____________

1

1 2

2 3

3