Montana Form Clt-4 - Corporation License Tax Return - 2001

ADVERTISEMENT

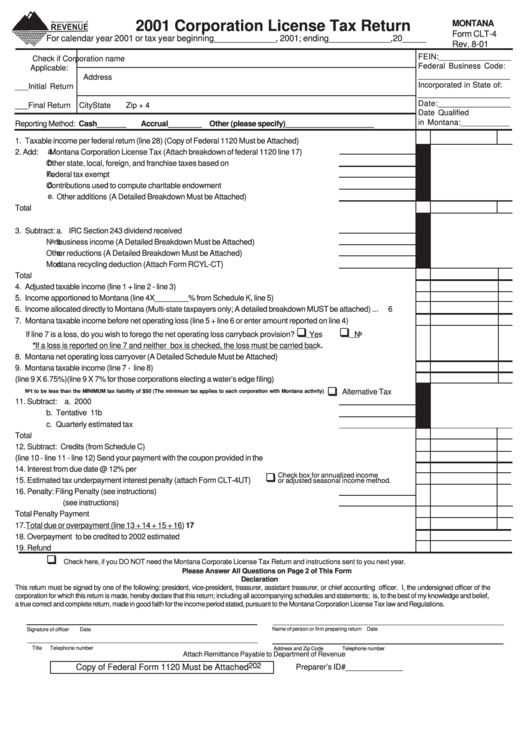

2001 Corporation License Tax Return

MONTANA

Form CLT-4

For calendar year 2001 or tax year beginning_____________, 2001; ending_____________,20_____

Rev. 8-01

FEIN:________________

Check if

Corporation name

Federal Business Code:

Applicable:

____________________

Address

Incorporated in State of:

___Initial Return

____________________

Date:________________

___Final Return

City

State

Zip + 4

Date Qualified

in Montana:___________

Reporting Method: Cash_______

Accrual________ Other (please specify)_____________________

1. Taxable income per federal return (line 28) (Copy of Federal 1120 Must be Attached)........................................................... 1

2. Add:

a.

Montana Corporation License Tax (Attach breakdown of federal 1120 line 17).......... 2a

b.

Other state, local, foreign, and franchise taxes based on income................................2b

c.

Federal tax exempt interest............................................................................................2c

d.

Contributions used to compute charitable endowment credit.......................................2d

e.

Other additions (A Detailed Breakdown Must be Attached)..........................................2e

Total Additions............................................................................................................................................................................................

2

3. Subtract:

a.

IRC Section 243 dividend received deduction..........................................................3a

b.

Nonbusiness income (A Detailed Breakdown Must be Attached)...........................3b

c.

Other reductions (A Detailed Breakdown Must be Attached)..................................3c

d.

Montana recycling deduction (Attach Form RCYL-CT)..........................................3d

Total Reductions.............................................................................................................................................................................

3

4. Adjusted taxable income (line 1 + line 2 - line 3)......................................................................................................................

4

5. Income apportioned to Montana (line 4X________% from Schedule K, line 5)......................................................................

5

6. Income allocated directly to Montana (Multi-state taxpayers only; A detailed breakdown MUST be attached)......................

6

7. Montana taxable income before net operating loss (line 5 + line 6 or enter amount reported on line 4)................................

7

If line 7 is a loss, do you wish to forego the net operating loss carryback provision?

Yes

No

*If a loss is reported on line 7 and neither box is checked, the loss must be carried back.

8. Montana net operating loss carryover (A Detailed Schedule Must be Attached).....................................................................

8

9. Montana taxable income (line 7 - line 8)...................................................................................................................................

9

10.Montana tax liability (line 9 X 6.75%)(line 9 X 7% for those corporations electing a water’s edge filing)............................... 10

Alternative Tax

Not to be less than the MINIMUM tax liability of $50 (The minimum tax applies to each corporation with Montana activity)

11. Subtract: a. 2000 overpayment................................................................................................11a

b. Tentative payment.................................................................................................11b

c. Quarterly estimated tax payments.......................................................................11c

Total Payments............................................................................................................................................................................ 11

12. Subtract: Credits (from Schedule C)........................................................................................................................................ 12

13.Tax due (line 10 - line 11 - line 12) Send your payment with the coupon provided in the booklet............................................ 13

14. Interest from due date @ 12% per annum................................................................................................................................ 14

Check box for annualized income

15. Estimated tax underpayment interest penalty (attach Form CLT-4UT).................................................................................. 15

or adjusted seasonal income method.

16. Penalty:

a.

Late Filing Penalty (see instructions)..................................................................16a

b.

Late Payment Penalty (see instructions)............................................................16b

Total Penalty Payment .............................................................................................................................................................. 16

17.Total due or overpayment (line 13 + 14 + 15 + 16).................................................................................................................... 17

18. Overpayment to be credited to 2002 estimated tax................................................................................................................. 18

19. Refund Due................................................................................................................................................................................ 19

Check here, if you DO NOT need the Montana Corporate License Tax Return and instructions sent to you next year.

Please Answer All Questions on Page 2 of This Form

Declaration

This return must be signed by one of the following: president, vice-president, treasurer, assistant treasurer, or chief accounting officer. I, the undersigned officer of the

corporation for which this return is made, hereby declare that this return; including all accompanying schedules and statements; is, to the best of my knowledge and belief,

a true correct and complete return, made in good faith for the income period stated, pursuant to the Montana Corporation License Tax law and Regulations.

Name of person or firm preparing return

Date

Signature of officer

Date

Title

Telephone number

Address and Zip Code

Telephone number

Attach Remittance Payable to Department of Revenue

202

Copy of Federal Form 1120 Must be Attached

Preparer’s ID#_____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2