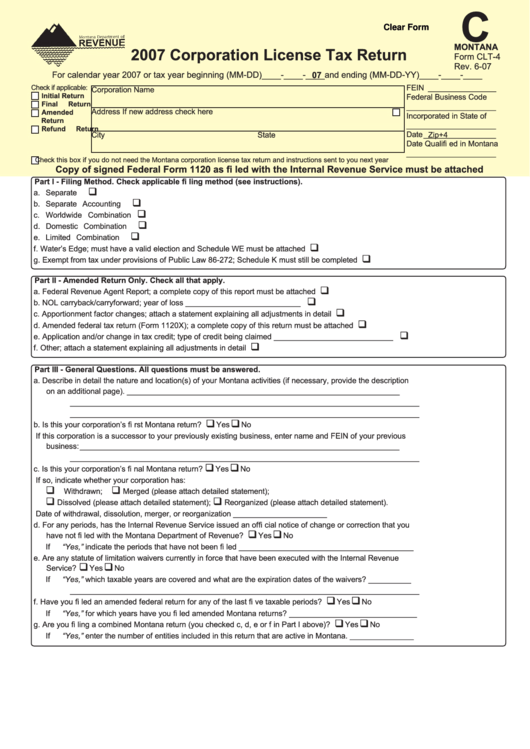

C

Clear Form

MONTANA

2007 Corporation License Tax Return

Form CLT-4

Rev. 6-07

For calendar year 2007 or tax year beginning (MM-DD)____-____-____and ending (MM-DD-YY)____-____-____

07

Check if applicable:

FEIN ________________

Corporation Name

Initial Return

Federal Business Code

Final Return

_____________________

Address

If new address check here

Amended

Incorporated in State of

Return

_____________________

Refund Return

Date _________________

City

State

Zip+4

Date Qualifi ed in Montana

_____________________

Check this box if you do not need the Montana corporation license tax return and instructions sent to you next year

Copy of signed Federal Form 1120 as fi led with the Internal Revenue Service must be attached

Part I - Filing Method. Check applicable fi ling method (see instructions).

a. Separate Company............................................................................................................................................................ a.

b. Separate Accounting ......................................................................................................................................................... b.

c. Worldwide Combination ......................................................................................................................................................c.

d. Domestic Combination ...................................................................................................................................................... d.

e. Limited Combination .......................................................................................................................................................... e.

f. Water’s Edge; must have a valid election and Schedule WE must be attached ................................................................ f.

g. Exempt from tax under provisions of Public Law 86-272; Schedule K must still be completed ........................................ g.

Part II - Amended Return Only. Check all that apply.

a. Federal Revenue Agent Report; a complete copy of this report must be attached ........................................................... a.

b. NOL carryback/carryforward; year of loss ___________________________

............................................................... b.

c. Apportionment factor changes; attach a statement explaining all adjustments in detail ....................................................c.

d. Amended federal tax return (Form 1120X); a complete copy of this return must be attached .......................................... d.

e. Application and/or change in tax credit; type of credit being claimed ____________________________ .................... e.

f. Other; attach a statement explaining all adjustments in detail ........................................................................................... f.

Part III - General Questions. All questions must be answered.

a. Describe in detail the nature and location(s) of your Montana activities (if necessary, provide the description

on an additional page). ________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

b. Is this your corporation’s fi rst Montana return? ........................................................................................................

Yes

No

If this corporation is a successor to your previously existing business, enter name and FEIN of your previous

business: ___________________________________________________________________________

__________________________________________________________________________________

c. Is this your corporation’s fi nal Montana return? ........................................................................................................

Yes

No

If so, indicate whether your corporation has:

Withdrawn;

Merged (please attach detailed statement);

Dissolved (please attach detailed statement);

Reorganized (please attach detailed statement).

Date of withdrawal, dissolution, merger, or reorganization ______________________

d. For any periods, has the Internal Revenue Service issued an offi cial notice of change or correction that you

have not fi led with the Montana Department of Revenue? ......................................................................................

Yes

No

If “Yes,” indicate the periods that have not been fi led _________________________________________

e. Are any statute of limitation waivers currently in force that have been executed with the Internal Revenue

Service? ...................................................................................................................................................................

Yes

No

If “Yes,” which taxable years are covered and what are the expiration dates of the waivers? __________

__________________________________________________________________________________

f. Have you fi led an amended federal return for any of the last fi ve taxable periods? .................................................

Yes

No

If “Yes,” for which years have you fi led amended Montana returns? ______________________________

g. Are you fi ling a combined Montana return (you checked c, d, e or f in Part I above)? .............................................

Yes

No

If “Yes,” enter the number of entities included in this return that are active in Montana. _______________

1

1 2

2 3

3