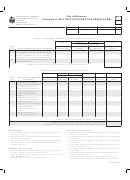

Student Credit Form - City Of Green, Ohio Division Of Taxation Page 2

ADVERTISEMENT

Click Here & Upgrade

Expanded Features

PDF

Unlimited Pages

Documents

Complete

Post Secondary Education Credit

Qualifying for the Credit

1) Must be a Green resident.

2) Must attend a “Qualifying post-secondary institution” which is defined as a “college,

university, technical school, vocational school or training program whose students are

eligible to receive grants and loans through programs established by the United States

Department of Education.”

3) Must file “Student Credit Form” and attach to a signed tax return.

4) Can not receive any tuition reimbursement or assistance from employer.

Specifically, a resident must be enrolled as a full time student for: “9 calendar months of the

year” or “4 calendar months of the year and continue as a full time student the following

calendar year.”

The “4 month” rule is interpreted to mean that a student won’t qualify unless that student

is enrolled for the entire following academic year. For instance, if a student graduates

from High School in 2007 and attends college for the fall term in 2007 (4 or 5 months

depending on whether quarters or semesters), that student will not qualify for the credit

for 2007 until that student is enrolled full time for 9 months (a standard academic year)

in 2008. As of January 1, 2009 that student would “qualify” for 2007 and 2008, but prior

to January 1, 2009 does not qualify for 2007. An amended 2007 return (claiming the

credit) can be filed after January 1, 2009 when the student is eligible for the credit.

The Student Credit Form is valid for income of up to $15,000 regardless of where the income

was earned or how much was withheld or not withheld. If income is over $15,000 and there are

multiple W-2’s with varying withholding rates (no withholding to 2.25% in Akron), the credit

could be calculated several ways depending on the number of W-2’s and the withholding rates. It

is recommended that these taxpayers come to the tax office so the maximum credit can be

calculated.

(Rev12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2