Sales And Use Tax Symposium Form - Maine Bureau Of Taxation

ADVERTISEMENT

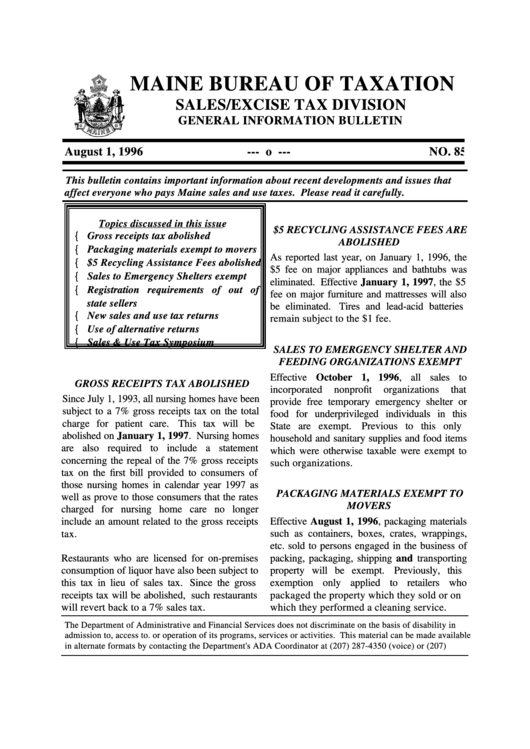

MAINE BUREAU OF TAXATION

SALES/EXCISE TAX DIVISION

GENERAL INFORMATION BULLETIN

August 1, 1996

--- o ---

NO. 85

This bulletin contains important information about recent developments and issues that

affect everyone who pays Maine sales and use taxes. Please read it carefully.

Topics discussed in this issue

$5 RECYCLING ASSISTANCE FEES ARE

{ Gross receipts tax abolished

ABOLISHED

{ Packaging materials exempt to movers

As reported last year, on January 1, 1996, the

{ $5 Recycling Assistance Fees abolished

$5 fee on major appliances and bathtubs was

{ Sales to Emergency Shelters exempt

eliminated. Effective January 1, 1997, the $5

{ Registration requirements of out of

fee on major furniture and mattresses will also

state sellers

be eliminated.

Tires and lead-acid batteries

{ New sales and use tax returns

remain subject to the $1 fee.

{ Use of alternative returns

{ Sales & Use Tax Symposium

SALES TO EMERGENCY SHELTER AND

FEEDING ORGANIZATIONS EXEMPT

Effective October 1, 1996, all sales to

GROSS RECEIPTS TAX ABOLISHED

incorporated

nonprofit

organizations

that

Since July 1, 1993, all nursing homes have been

provide free temporary emergency shelter or

subject to a 7% gross receipts tax on the total

food for underprivileged individuals in this

charge for patient care.

This tax will be

State are exempt.

Previous to this only

abolished on January 1, 1997. Nursing homes

household and sanitary supplies and food items

are also required to include a statement

which were otherwise taxable were exempt to

concerning the repeal of the 7% gross receipts

such organizations.

tax on the first bill provided to consumers of

those nursing homes in calendar year 1997 as

PACKAGING MATERIALS EXEMPT TO

well as prove to those consumers that the rates

MOVERS

charged for nursing home care no longer

include an amount related to the gross receipts

Effective August 1, 1996, packaging materials

tax.

such as containers, boxes, crates, wrappings,

etc. sold to persons engaged in the business of

Restaurants who are licensed for on-premises

packing, packaging, shipping and transporting

consumption of liquor have also been subject to

property will be exempt.

Previously, this

this tax in lieu of sales tax. Since the gross

exemption only applied to retailers who

receipts tax will be abolished, such restaurants

packaged the property which they sold or on

will revert back to a 7% sales tax.

which they performed a cleaning service.

The Department of Administrative and Financial Services does not discriminate on the basis of disability in

admission to, access to. or operation of its programs, services or activities. This material can be made available

in alternate formats by contacting the Department's ADA Coordinator at (207) 287-4350 (voice) or (207)

287-4537 (TTY).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4