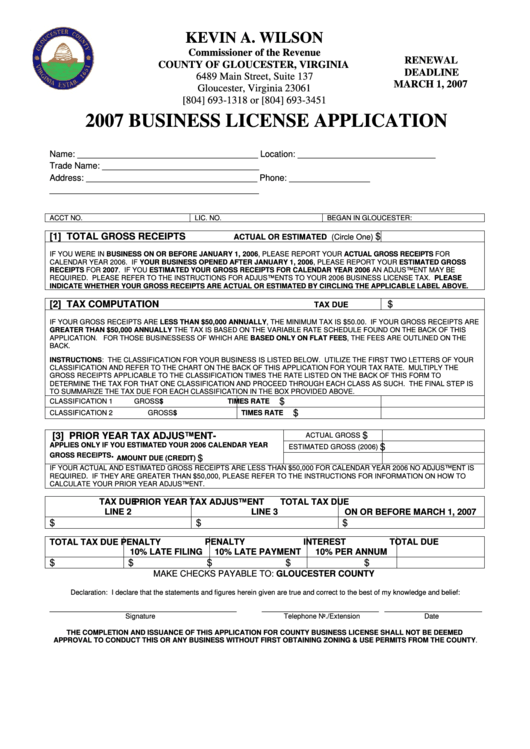

2007 Business License Application Form - Virginia

ADVERTISEMENT

KEVIN A. WILSON

Commissioner of the Revenue

RENEWAL

COUNTY OF GLOUCESTER, VIRGINIA

DEADLINE

6489 Main Street, Suite 137

MARCH 1, 2007

Gloucester, Virginia 23061

[804] 693-1318 or [804] 693-3451

2007 BUSINESS LICENSE APPLICATION

Name: ______________________________________

Location: _____________________________

Trade Name: _________________________________

Address: ____________________________________

Phone: _________________

____________________________________________

ACCT NO.

LIC. NO.

BEGAN IN GLOUCESTER:

[1] TOTAL GROSS RECEIPTS

$

ACTUAL OR ESTIMATED (Circle One)

IF YOU WERE IN BUSINESS ON OR BEFORE JANUARY 1, 2006, PLEASE REPORT YOUR ACTUAL GROSS RECEIPTS FOR

CALENDAR YEAR 2006. IF YOUR BUSINESS OPENED AFTER JANUARY 1, 2006, PLEASE REPORT YOUR ESTIMATED GROSS

RECEIPTS FOR 2007. IF YOU ESTIMATED YOUR GROSS RECEIPTS FOR CALENDAR YEAR 2006 AN ADJUSTMENT MAY BE

REQUIRED. PLEASE REFER TO THE INSTRUCTIONS FOR ADJUSTMENTS TO YOUR 2006 BUSINESS LICENSE TAX. PLEASE

INDICATE WHETHER YOUR GROSS RECEIPTS ARE ACTUAL OR ESTIMATED BY CIRCLING THE APPLICABLE LABEL ABOVE.

[2] TAX COMPUTATION

$

TAX DUE

IF YOUR GROSS RECEIPTS ARE LESS THAN $50,000 ANNUALLY, THE MINIMUM TAX IS $50.00. IF YOUR GROSS RECEIPTS ARE

GREATER THAN $50,000 ANNUALLY THE TAX IS BASED ON THE VARIABLE RATE SCHEDULE FOUND ON THE BACK OF THIS

APPLICATION. FOR THOSE BUSINESSESS OF WHICH ARE BASED ONLY ON FLAT FEES, THE FEES ARE OUTLINED ON THE

BACK.

INSTRUCTIONS: THE CLASSIFICATION FOR YOUR BUSINESS IS LISTED BELOW. UTILIZE THE FIRST TWO LETTERS OF YOUR

CLASSIFICATION AND REFER TO THE CHART ON THE BACK OF THIS APPLICATION FOR YOUR TAX RATE. MULTIPLY THE

GROSS RECEIPTS APPLICABLE TO THE CLASSIFICATION TIMES THE RATE LISTED ON THE BACK OF THIS FORM TO

DETERMINE THE TAX FOR THAT ONE CLASSIFICATION AND PROCEED THROUGH EACH CLASS AS SUCH. THE FINAL STEP IS

TO SUMMARIZE THE TAX DUE FOR EACH CLASSIFICATION IN THE BOX PROVIDED ABOVE.

$

CLASSIFICATION 1

GROSS$

TIMES RATE

$

CLASSIFICATION 2

GROSS$

TIMES RATE

[3] PRIOR YEAR TAX ADJUSTMENT-

$

ACTUAL GROSS

APPLIES ONLY IF YOU ESTIMATED YOUR 2006 CALENDAR YEAR

$

ESTIMATED GROSS (2006)

.

GROSS RECEIPTS

$

AMOUNT DUE (CREDIT)

IF YOUR ACTUAL AND ESTIMATED GROSS RECEIPTS ARE LESS THAN $50,000 FOR CALENDAR YEAR 2006 NO ADJUSTMENT IS

REQUIRED. IF THEY ARE GREATER THAN $50,000, PLEASE REFER TO THE INSTRUCTIONS FOR INFORMATION ON HOW TO

CALCULATE YOUR PRIOR YEAR ADJUSTMENT.

TAX DUE

PRIOR YEAR TAX ADJUSTMENT

TOTAL TAX DUE

LINE 2

LINE 3

ON OR BEFORE MARCH 1, 2007

$

$

$

TOTAL TAX DUE

PENALTY

PENALTY

INTEREST

TOTAL DUE

10% LATE FILING

10% LATE PAYMENT

10% PER ANNUM

$

$

$

$

$

MAKE CHECKS PAYABLE TO: GLOUCESTER COUNTY

Declaration: I declare that the statements and figures herein given are true and correct to the best of my knowledge and belief:

________________________________________________

______________________________ _________________________

Signature

Telephone No./Extension

Date

THE COMPLETION AND ISSUANCE OF THIS APPLICATION FOR COUNTY BUSINESS LICENSE SHALL NOT BE DEEMED

APPROVAL TO CONDUCT THIS OR ANY BUSINESS WITHOUT FIRST OBTAINING ZONING & USE PERMITS FROM THE COUNTY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2