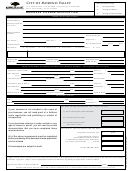

2007 Business License Application Form - Virginia Page 2

ADVERTISEMENT

Business License Rate Schedule

Businesses that have gross receipts of more than $50,000 and flat rate businesses use the tax rate

schedule below. Your classification is listed on the front of this application on the line showing your

Class of Business. Use the first two letters.

This tax rate schedule below applies to businesses that have a total gross of more than $50,000

and flat rate businesses; otherwise the license fee of $50.00 is due only.

Class AG – Automobile Graveyards = 5-20 vehicles $30.00; over 20 vehicles $50.00. (Prior application must be made with the County Administrator.)

Class AO - Amusement Operators = $50.00 plus .10 per $100 of gross receipts (Upon renewal each year, must furnish list of machines located in

Gloucester County with addresses.)

Class CA – Carnivals = $10.00 per day (Concessions not owned by carnival may require separate license.)

Class CO - Contractors and persons contracting for their own account for sale = .10 per $100 of gross receipts or $50 minimum (Workers’ Compensation

questionnaire must be completed before license can be issued.)

Class DS - Direct sellers = .10 per $100 of gross receipts or $50 minimum. No fee for gross receipts under $4,000.

Class FS – Financial Services = .12 per $100 of gross receipts or $50 minimum.

Class FT - Fortune Tellers, Clairvoyant, Palmistry = $500 fee (Prior to licensing & renewing each year, the applicant must report to the County Sheriff’s

office for a police check, including being photographed and fingerprinted.)

Class IM – Itinerant Merchant of all types = $500.00 fee (must get zoning permit prior to license each year)

Class JY – Junkyard = .10 per $100 of gross receipts or $50 minimum (Prior application must be made with the County Administrator.)

Class MP – Massage Parlor = $1,000.00 fee (Prior application at Gloucester County Health Dept. for investigation is required, accompanied by a non-

refundable filing fee of $1,000.00. The license fee is additional.)

Class PE – Peddlers of all types = $500.00 fee (Special peddler’s parking regulations must be met.)

Class PS – Professional Services = .12 per $100 of gross receipts or $50 minimum.

Class RE – Real Estate Services = .12 per $100 of gross receipts or $50 minimum.

Class RM - Retail Merchant = .10 per $100 of gross receipts of $200,000 or less and .20 per $100 of gross receipts over $200,000 or $50 minimum.

Class SE – Services- Repair, Personal, Business Services and all other business occupations = .10 per $100 of gross receipts or $50 minimum.

:

Such businesses include, but are not limited to, the following

•

Auctioneers

•

Barber Shops

•

Beauty Shops

•

Billboard and Billboard owners

•

Bondsman (Must obtain certificate from Judge of Circuit Court of Gloucester County and a copy of $200,000 bond or assets made

payable to the Commonwealth of Virginia is required before license can be issued.)

•

Bowling Alleys

•

Certified Massage Therapist (Certified by State of Virginia and a Current copy of certificate issued by the Regulatory Board of Virginia is

required before license can be issued)

•

Child Care (Five (5) children or less, excluding own, no zoning required; however, check with Social Services for State license details.)

•

Cleaning and/or pumping septic tanks

•

Commissioned Merchant

•

Exterminators

•

Health Spa/Services

•

Pawnbrokers (Before license can be issued, authority must be granted by the Circuit Court of Gloucester County and a copy of a $50,000

bond made payable to Gloucester County is required)

•

Photographers

•

Pool Rooms

•

Refuse Haulers (Vehicles must pass yearly inspection of County Engineer)

•

Security/Investigative Services

•

Tourists Courts, travel trailer parks, hotels, motels, motor lodges, etc.

•

Undertakers

Class SL – Savings and Loan Associations = $50.00 (Main office only)

Class TE – Telegraph and Telephone Companies = ½ of 1 percent of gross receipts (Charges for long distance telephone calls not included in gross

receipts)

Class WA – Water or Heat, Light and Power Companies = ½ of 1 percent of gross receipts

Class WS – Wholesale Merchants of all types = .05 per $100 of gross purchases or $50 minimum.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2