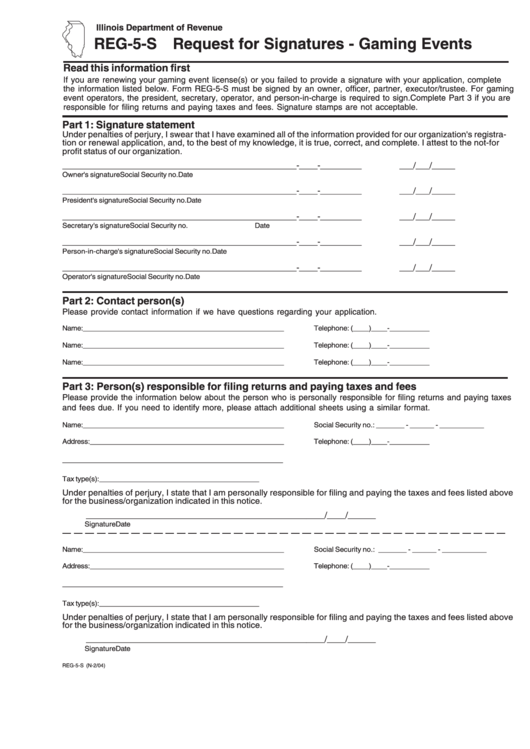

Reg-5-S - Request For Signatures - Gaming Events Form

ADVERTISEMENT

Illinois Department of Revenue

REG-5-S

Request for Signatures - Gaming Events

Read this information first

If you are renewing your gaming event license(s) or you failed to provide a signature with your application, complete

the information listed below. Form REG-5-S must be signed by an owner, officer, partner, executor/trustee. For gaming

event operators, the president, secretary, operator, and person-in-charge is required to sign. Complete Part 3 if you are

responsible for filing returns and paying taxes and fees. Signature stamps are not acceptable.

Part 1: Signature statement

Under penalties of perjury, I swear that I have examined all of the information provided for our organization's registra-

tion or renewal application, and, to the best of my knowledge, it is true, correct, and complete. I attest to the not-for

profit status of our organization.

______________________________________________

_____-____-_________

___/___/_____

Owner's signature

Social Security no.

Date

______________________________________________

_____-____-_________

___/___/_____

President's signature

Social Security no.

Date

______________________________________________

_____-____-_________

___/___/_____

Secretary's signature

Social Security no.

Date

______________________________________________

_____-____-_________

___/___/_____

Person-in-charge's signature

Social Security no.

Date

______________________________________________

_____-____-_________

___/___/_____

Operator's signature

Social Security no.

Date

Part 2: Contact person(s)

Please provide contact information if we have questions regarding your application.

Name:___________________________________________________

Telephone: (____)____-__________

Name:___________________________________________________

Telephone: (____)____-__________

Name:___________________________________________________

Telephone: (____)____-__________

Part 3: Person(s) responsible for filing returns and paying taxes and fees

Please provide the information below about the person who is personally responsible for filing returns and paying taxes

and fees due. If you need to identify more, please attach additional sheets using a similar format.

Name:___________________________________________________

Social Security no.: _______ - ______ - ___________

Address:_________________________________________________

Telephone: (____)____-__________

________________________________________________

Tax type(s):________________________________________

Under penalties of perjury, I state that I am personally responsible for filing and paying the taxes and fees listed above

for the business/organization indicated in this notice.

______________________________________________

____/____/______

Signature

Date

Name:___________________________________________________

Social Security no.: _______ - ______ - ___________

Address:_________________________________________________

Telephone: (____)____-__________

________________________________________________

Tax type(s):________________________________________

Under penalties of perjury, I state that I am personally responsible for filing and paying the taxes and fees listed above

for the business/organization indicated in this notice.

______________________________________________

____/____/______

Signature

Date

REG-5-S (N-2/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1