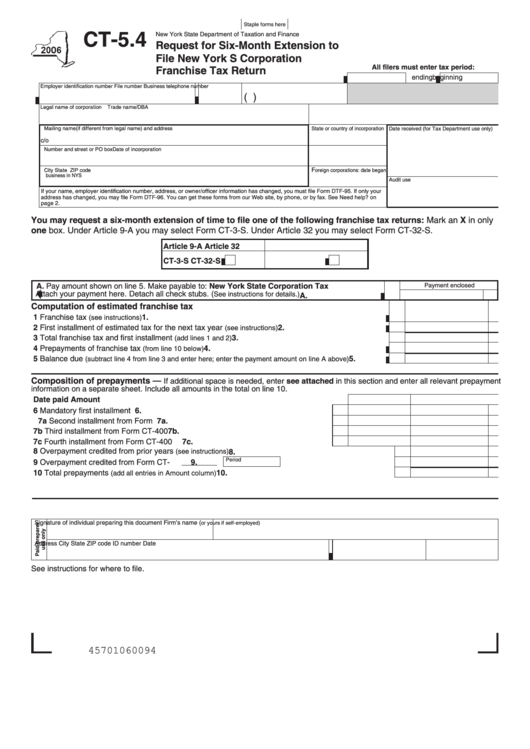

Staple forms here

CT-5.4

New York State Department of Taxation and Finance

Request for Six-Month Extension to

File New York S Corporation

All filers must enter tax period:

Franchise Tax Return

beginning

ending

Employer identification number

File number

Business telephone number

(

)

Legal name of corporation

Trade name/DBA

Mailing name (if different from legal name) and address

State or country of incorporation

Date received (for Tax Department use only)

c/o

Number and street or PO box

Date of incorporation

F

City

State

ZIP code

oreign corporations: date began

business in NYS

Audit use

If your name, employer identification number, address, or owner/officer information has changed, you must file Form DTF-95. If only your

address has changed, you may file Form DTF-96. You can get these forms from our Web site, by phone, or by fax. See Need help? on

page 2.

You may request a six-month extension of time to file one of the following franchise tax returns: Mark an X in only

one box. Under Article 9-A you may select Form CT-3-S. Under Article 32 you may select Form CT-32-S.

Article 9-A

Article 32

CT-3-S

CT-32-S

A. Pay amount shown on line 5. Make payable to: New York State Corporation Tax

Payment enclosed

Attach your payment here. Detach all check stubs. (

See instructions for details.)

A.

Computation of estimated franchise tax

1 Franchise tax

1.

.........................................................................................................

(see instructions)

2 First installment of estimated tax for the next tax year

..........................................

2.

(see instructions)

3 Total franchise tax and first installment

.................................................................

3.

(add lines 1 and 2)

4 Prepayments of franchise tax

............................................................................

4.

(from line 10 below)

5 Balance due

5.

.........

(subtract line 4 from line 3 and enter here; enter the payment amount on line A above)

Composition of prepayments —

If additional space is needed, enter see attached in this section and enter all relevant prepayment

information on a separate sheet. Include all amounts in the total on line 10.

Date paid

Amount

6 Mandatory first installment .....................................................................................

6.

7a Second installment from Form CT-400................................................................... 7a.

7b Third installment from Form CT-400....................................................................... 7b.

7c Fourth installment from Form CT-400 .................................................................... 7c.

8 Overpayment credited from prior years

.....................................................................

(see instructions)

8.

Period

9 Overpayment credited from Form CT-

.................................................

9.

10 Total prepayments

............................................................................. 10.

(add all entries in Amount column)

Signature of individual preparing this document

Firm’s name (

or yours if self-employed)

Address

City

State

ZIP code

ID number

Date

See instructions for where to file.

45701060094

1

1