Form Dr-15ezcs Sales And Use Tax Return Florida

ADVERTISEMENT

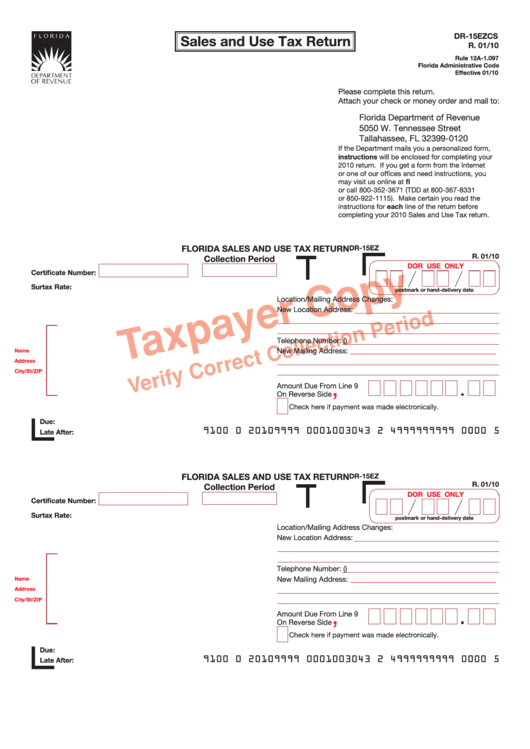

DR-15EZCS

Sales and Use Tax Return

R. 01/10

Rule 12A-1.097

Florida Administrative Code

Effective 01/10

Please complete this return.

Attach your check or money order and mail to:

Florida Department of Revenue

5050 W. Tennessee Street

Tallahassee, FL 32399-0120

If the Department mails you a personalized form,

instructions will be enclosed for completing your

2010 return. If you get a form from the Internet

or one of our offices and need instructions, you

may visit us online at

or call 800-352-3671 (TDD at 800-367-8331

or 850-922-1115). Make certain you read the

instructions for each line of the return before

completing your 2010 Sales and Use Tax return.

FLORIDA SALES AND USE TAX RETURN

DR-15EZ

R. 01/10

Collection Period

DOR USE ONLY

Certificate Number:

Surtax Rate:

postmark or hand-delivery date

Location/Mailing Address Changes:

New Location Address:

Telephone Number: (

)

New Mailing Address:

________________________________________

Name

Address

City/St/ZIP

,

Amount Due From Line 9

On Reverse Side

Check here if payment was made electronically.

Due:

9100 0 20109999 0001003043 2 4999999999 0000 5

Late After:

FLORIDA SALES AND USE TAX RETURN

DR-15EZ

R. 01/10

Collection Period

DOR USE ONLY

Certificate Number:

Surtax Rate:

postmark or hand-delivery date

Location/Mailing Address Changes:

New Location Address:

Telephone Number: (

)

New Mailing Address:

________________________________________

Name

Address

City/St/ZIP

,

Amount Due From Line 9

On Reverse Side

Check here if payment was made electronically.

Due:

9100 0 20109999 0001003043 2 4999999999 0000 5

Late After:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2