Form Dr-15air - Sales And Use Tax Return For Aircraft

ADVERTISEMENT

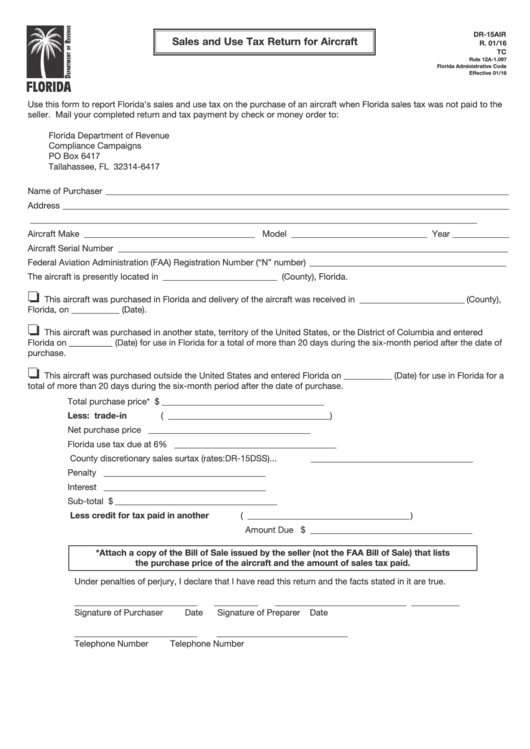

DR-15AIR

Sales and Use Tax Return for Aircraft

R. 01/16

TC

Rule 12A-1.097

Florida Administrative Code

Effective 01/16

Use this form to report Florida’s sales and use tax on the purchase of an aircraft when Florida sales tax was not paid to the

seller. Mail your completed return and tax payment by check or money order to:

Florida Department of Revenue

Compliance Campaigns

PO Box 6417

Tallahassee, FL 32314-6417

Name of Purchaser ____________________________________________________________________________________________

Address ______________________________________________________________________________________________________

______________________________________________________________________________________________________

Aircraft Make _______________________________________ Model _______________________________ Year _____________

Aircraft Serial Number _________________________________________________________________________________________

Federal Aviation Administration (FAA) Registration Number (“N” number) _____________________________________________

The aircraft is presently located in __________________________ (County), Florida.

o

This aircraft was purchased in Florida and delivery of the aircraft was received in ________________________ (County),

Florida, on ___________ (Date).

o

This aircraft was purchased in another state, territory of the United States, or the District of Columbia and entered

Florida on __________ (Date) for use in Florida for a total of more than 20 days during the six-month period after the date of

purchase.

o

This aircraft was purchased outside the United States and entered Florida on ___________ (Date) for use in Florida for a

total of more than 20 days during the six-month period after the date of purchase.

Total purchase price* ...................................................

$ _____________________________________

Less: trade-in ............................................................

( _____________________________________ )

Net purchase price ......................................................

_____________________________________

Florida use tax due at 6% ............................................

_____________________________________

County discretionary sales surtax (rates:DR-15DSS)...

_____________________________________

Penalty .........................................................................

_____________________________________

Interest .........................................................................

_____________________________________

Sub-total ......................................................................

$ _____________________________________

Less credit for tax paid in another state...................

( _____________________________________ )

Amount Due $ _____________________________________

*Attach a copy of the Bill of Sale issued by the seller (not the FAA Bill of Sale) that lists

the purchase price of the aircraft and the amount of sales tax paid.

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true.

____________________________

__________

______________________________

___________

Signature of Purchaser

Date

Signature of Preparer

Date

____________________________

______________________________

Telephone Number

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2