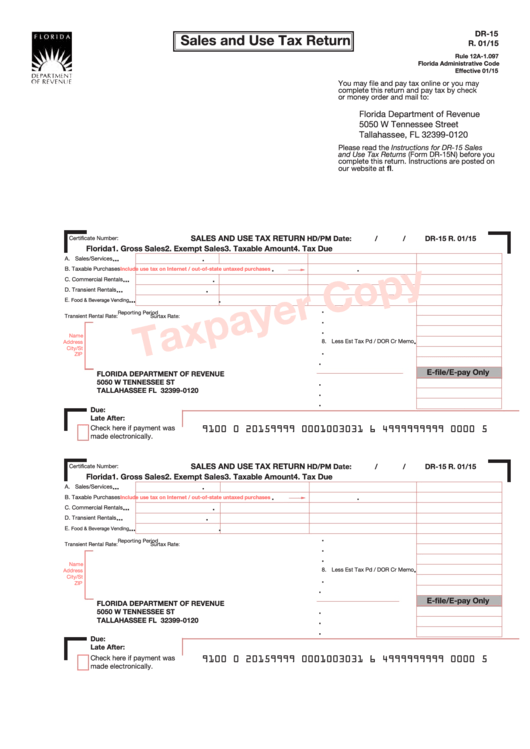

DR-15

Sales and Use Tax Return

R. 01/15

Rule 12A-1.097

Florida Administrative Code

Effective 01/15

You may file and pay tax online or you may

complete this return and pay tax by check

or money order and mail to:

Florida Department of Revenue

5050 W Tennessee Street

Tallahassee, FL 32399-0120

Please read the Instructions for DR-15 Sales

and Use Tax Returns (Form DR-15N) before you

complete this return. Instructions are posted on

our website at

SALES AND USE TAX RETURN

HD/PM Date:

/

/

DR-15 R. 01/15

Certificate Number:

Florida

1. Gross Sales

2. Exempt Sales

3. Taxable Amount

4. Tax Due

.

.

.

.

A. Sales/Services

.

.

B. Taxable Purchases

Include use tax on Internet / out-of-state untaxed purchases

.

.

.

.

C. Commercial Rentals

.

.

.

.

D. Transient Rentals

.

.

.

.

E.

Food & Beverage Vending

.

5. Total Amount of Tax Due

Reporting Period

Transient Rental Rate:

Surtax Rate:

.

6. Less Lawful Deductions

.

7. Net Tax Due

Name

.

8. Less Est Tax Pd / DOR Cr Memo

Address

City/St

.

9. Plus Est Tax Due Current Month

ZIP

.

10. Amount Due

E-file/E-pay Only

11. Less Collection Allowance

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

.

12. Plus Penalty

TALLAHASSEE FL 32399-0120

.

13. Plus Interest

.

14. Amount Due with Return

Due:

Late After:

Check here if payment was

9100 0 20159999 0001003031 6 4999999999 0000 5

made electronically.

SALES AND USE TAX RETURN

HD/PM Date:

/

/

DR-15 R. 01/15

Certificate Number:

Florida

1. Gross Sales

2. Exempt Sales

3. Taxable Amount

4. Tax Due

.

.

.

.

A. Sales/Services

.

.

B. Taxable Purchases

Include use tax on Internet / out-of-state untaxed purchases

.

.

.

.

C. Commercial Rentals

.

.

.

.

D. Transient Rentals

.

.

.

.

E.

Food & Beverage Vending

.

5. Total Amount of Tax Due

Reporting Period

Transient Rental Rate:

Surtax Rate:

.

6. Less Lawful Deductions

.

7. Net Tax Due

Name

.

8. Less Est Tax Pd / DOR Cr Memo

Address

City/St

.

9. Plus Est Tax Due Current Month

ZIP

.

10. Amount Due

E-file/E-pay Only

11. Less Collection Allowance

FLORIDA DEPARTMENT OF REVENUE

.

5050 W TENNESSEE ST

12. Plus Penalty

TALLAHASSEE FL 32399-0120

.

13. Plus Interest

.

14. Amount Due with Return

Due:

Late After:

Check here if payment was

9100 0 20159999 0001003031 6 4999999999 0000 5

made electronically.

1

1 2

2