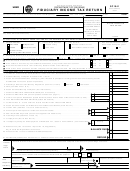

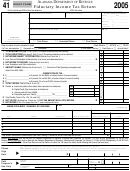

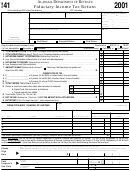

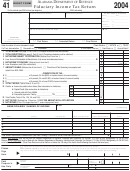

07000241

FORM

2007

41

Alabama Fiduciary Income Tax Return

PAGE 2

Name of estate or trust

Employer identification number

Name and title of fiduciary

SCHEDULE A – ALABAMA CHARITABLE DEDUCTION. Do not complete for a simple trust or a pooled income fund.

1

00

1 Amounts paid or permanently set aside for charitable purposes from gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2 Alabama tax-exempt income allocable to charitable contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

3 Subtract line 2 from line1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

4 Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes . . . . . . . . . . . . . . . . . . . . . . .

5

00

5 Alabama Charitable Deduction. Add Line 3 and Line 4. Enter total here and on Page 3, Schedule C, Line 13, Column C . . . . . . . . . .

SCHEDULE B – COMPUTATION OF ALABAMA INCOME DISTRIBUTION DEDUCTION

1

00

1 Alabama Adjusted Total Income (Page 1, Line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 The amount of gain from the sale of capital assets, but only if the gain was allocated to corpus and not paid, credited,

2

00

or required to be distributed to any beneficiary during the taxable year or not included in Line 4, Schedule A (see instructions). . . . . . . .

3

00

3 Subtract the amount entered on Line 2 from the amount entered on Line 1, and enter in Line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 The amount of loss from the sale of capital assets – entered as a positive number, only if the loss was not considered

4

in the determination of the amount to be paid, credited, or required to be distributed to any beneficiary during taxable year . . . . . . . . . . .

00

5

5 Amount of tax exempt interest income excluded in computing Alabama taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6

6 Other adjustments – see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

7

7 Alabama Distributable Net Income (Sum of Lines 3 through 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

8 If a complex trust, enter accounting income for the tax year as determined under the

8

00

governing instrument and applicable local law. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Income required to be distributed currently. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

10

10 Other amounts paid, credited, or otherwise required to be distributed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

11

11 Total distributions. add Lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

12

12 Enter the amount of tax-exempt income included on Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

13

13 Tentative income distribution deduction. Subtract Line 12 from Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

14

14 Tentative income distribution deduction. Subtract Line 5 from Line 7. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

15

15 Special Alabama Income Distribution Deduction (see instructions for applicability of the special limitation) . . . . . . . . . . . . . . . . . . . . . . . . .

00

16 Alabama Income Distribution Deduction. Enter the smallest of Line 13, Line 14, or, if applicable, Line 15,

00

16

on this line and on Page 1, Line 2. (Do not enter less than zero.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADOR

1

1 2

2 3

3 4

4 5

5