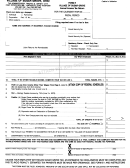

Form R - Annual Income Tax Return Page 2

ADVERTISEMENT

PAGE 2 – FORM R

THIS SECTION TO BE COMPLETED ONLY BY THOSE WITH PROFIT OR LOSS FROM INCOME OTHER THAN WAGES

10. ALLOWABLE PRIOR YEAR LOSS CARRY FORWARD TO CURRENT YEAR (Attach year-by-year details) ..................... 10

$______________

11. PROFIT OR LOSS FROM ANY BUSINESS OWNED (from Sch X, line 5 below) ................................................................. 11

$______________

12. RENTAL INCOME (Attach Federal Schedule E, Part I) &/or Farm Income (Attach Federal Schedule F) ............................. 12

$______________

13. PASS-THROUGH INCOME(Attach Federal Schedule E, Parts II to V) (Report only income not already taxed by Carroll at entity level) ........ 13

$______________

14. OTHER INCOME (Attach Federal 1040 Pg 1) (1099-MISC, Form 4797 Ordinary Income) .................................................. 14

$______________

15. TOTAL OTHER TAXABLE INCOME (Add Lines 10 to 14). If positive, enter on line 2, page 1. If negative, enter zero. ........ 15

$______________

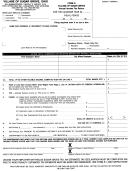

Attach any Adjusting Schedules or Worksheets including Pages 1 and 2 of Sch C & F; Pages 1 to 4 of 1120, 1120S, 1065, 1041

SCHEDULE X Business Income Schedule (including resident pass-through income)

1.

INCOME PER FEDERAL RETURN C Corp: Form 1120, S Corp: Form 1120S, Partnership: Form 1065, Trust: Form1041, Self-employment: Sch C.,

Farm: Sch F, ............................................................................................................................................................... $____________________

ITEMS NOT TAXABLE

DEDUCT

ITEMS NOT DEDUCTIBLE

ADD

A. Capital/Ordinary IRS Section 1231 losses deducted .......... _________________

K. Capital/IRS Section 1231 gains, etc. .................................. _________________

B. 5% of expenses not attributable to sale, exchange .............

L. Interest earned or accrued

........................................ _________________

or other disposition of IRS Section 1221 property ............... _________________

C. Tax based on income

........................................ _________________

M. Dividends

........................................ _________________

D. Guaranteed payment to partners ........................................ _________________

(not included within net profits)

N. Income from patents, etc.

........................................ _________________

E. Charitable contributions deducted above corporate

O. Other exempt income (attach documentation or explanation) .. _________________

limitations including O.R.C. 718.01 (A) (1) (g) .................... _________________

F. IRS Section 179 expense deducted above corporate

_____________________________________________________ ... _________________

limitations including O.R.C. 718.01 (A) (1) (g) .................... _________________

G. Qualified retirement, health ins. and life ins. Plans

_____________________________________________________ ... _________________

on behalf of owners/owner employees .............................. _________________

_____________________________________________________ ... _________________

H. Adjustment for specially allocated expense items .............. _________________

I. Other expenses not deductible

_____________________________________________________ ... _________________

(attach documentation or explanation) ................................. _________________

J. TOTAL ADDITIONS (enter on Line 2A above) .................... _________________

P. TOTAL DEDUCTIONS (enter on Line 2B above) ................ _________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2