Annual Statement Of Financial Disclosure: Request For Delayed Filing Of Information Effected By An I.r.s. Individual Income Tax Return Extension Form - New York

ADVERTISEMENT

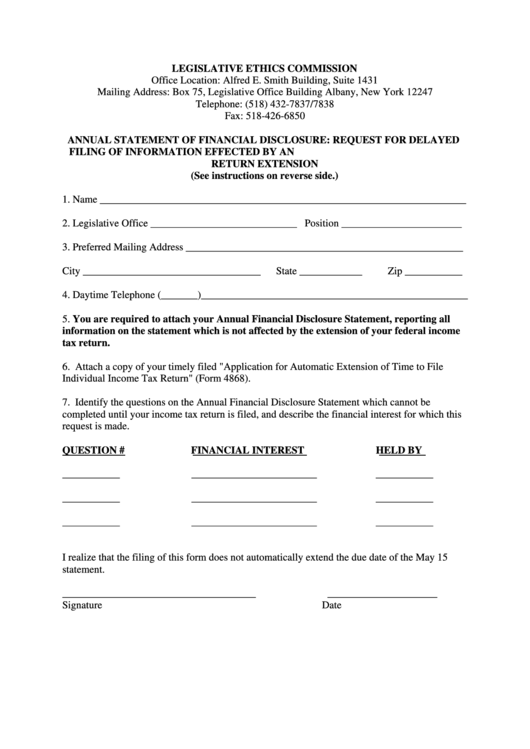

LEGISLATIVE ETHICS COMMISSION

Office Location: Alfred E. Smith Building, Suite 1431

Mailing Address: Box 75, Legislative Office Building Albany, New York 12247

Telephone: (518) 432-7837/7838

Fax: 518-426-6850

ANNUAL STATEMENT OF FINANCIAL DISCLOSURE: REQUEST FOR DELAYED

FILING OF INFORMATION EFFECTED BY AN I.R.S. INDIVIDUAL INCOME TAX

RETURN EXTENSION

(See instructions on reverse side.)

1. Name ______________________________________________________________________

2. Legislative Office ____________________________ Position _______________________

3. Preferred Mailing Address _____________________________________________________

City __________________________________

State ____________

Zip ___________

4. Daytime Telephone (_______)___________________________________________________

5. You are required to attach your Annual Financial Disclosure Statement, reporting all

information on the statement which is not affected by the extension of your federal income

tax return.

6. Attach a copy of your timely filed "Application for Automatic Extension of Time to File U.S.

Individual Income Tax Return" (Form 4868).

7. Identify the questions on the Annual Financial Disclosure Statement which cannot be

completed until your income tax return is filed, and describe the financial interest for which this

request is made.

QUESTION #

FINANCIAL INTEREST

HELD BY

___________

________________________

___________

___________

________________________

___________

___________

________________________

___________

I realize that the filing of this form does not automatically extend the due date of the May 15

statement.

_____________________________________

_____________________

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2