Form Pit-B - New Mexico Allocation And Apportionment Of Income Schedule - 1999

ADVERTISEMENT

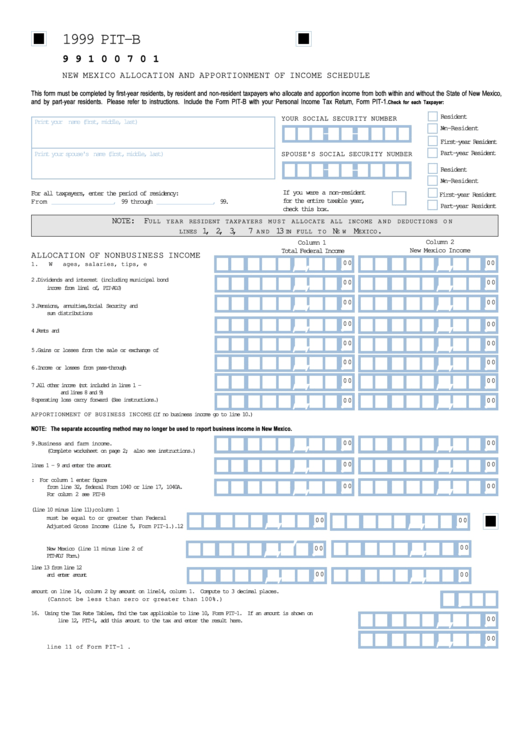

1999 PIT-B

9 9 1 0 0 7 0 1

NEW MEXICO ALLOCATION AND APPORTIONMENT OF INCOME SCHEDULE

This form must be completed by first-year residents, by resident and non-resident taxpayers who allocate and apportion income from both within and without the State of New Mexico,

and by part-year residents. Please refer to instructions. Include the Form PIT-B with your Personal Income Tax Return, Form PIT-1.

Check for each Taxpayer:

Resident

YOUR SOCIAL SECURITY NUMBER

Print your name (first, middle, last)

Non-Resident

-

-

First-year Resident

Part-year Resident

Print your spouse's name (first, middle, last)

SPOUSE'S SOCIAL SECURITY NUMBER

-

-

Resident

Non-Resident

If you were a non-resident

For all taxpayers, enter the period of residency:

First-year Resident

for the entire taxable year,

From

_________________,

99 through

________________,

9 9 .

Part-year Resident

check this box.

NOTE: F

ULL Y E A R RESIDENT TAXPAYERS M U S T ALLOCATE ALL INCOME A N D DEDUCTIONS O N

1 , 2 , 3 , 7

1 3

N

M

.

LINES

A N D

I N FULL T O

E W

EXICO

Column 2

Column 1

New Mexico Income

Total Federal Income

ALLOCATION OF NONBUSINESS INCOME

,

,

,

,

.

.

0 0

0 0

1 .

W a g e s , s a l a r i e s , t i p s , e t c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

,

,

,

,

.

.

2 .

Dividends and interest (including municipal bond

0 0

0 0

i n c o m e f r o m l i n e 1 o f , P I T - A D J ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

,

,

,

,

.

.

0 0

0 0

3 .

Pension s , a n n u i t i e s , S o c i a l Se curi ty an d lump ........... ........3

sum distributions

,

,

,

,

.

.

0 0

0 0

4 .

R e n t s a n d r o y a l t i e s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

,

,

,

,

.

.

0 0

0 0

5 .

Gains or losses from the sale or exchange of property.....5

,

,

,

,

.

.

0 0

0 0

6 .

I n c o m e o r l o s s e s f r o m p a s s - t h r o u g h e n t i t i e s . . . . . . . . . . . . . . . . . . . . 6

,

,

,

,

.

.

0 0

0 0

7 .

A l l o t h e r i n c o m e ( n o t i n c l u d e d i n l i n e s 1 - 6 . . . . . . . . . . . . . . . . . . . . . . 7

a n d l i n e s 8 a n d 9 )

,

,

,

,

.

.

8 .

Net operating loss carry forward (See instructions.)..........8

0 0

0 0

APPORTIONMENT OF BUSINESS INCOME(If no business income go to line 10.)

NOTE: The separate accounting method may no longer be used to report business income in New Mexico.

,

,

,

,

.

.

0 0

0 0

9 .

Business and farm income.

(Complete worksheet on page 2; also see instructions.)....9

,

,

,

,

.

.

0 0

0 0

1 0 .

ADD l i n e s 1 - 9 a n d e n t e r t h e a m o u n t h e r e . . . . . . . . . . . . . . . . . . . . . 1 0

1 1 .

Federal adjustments to income: For column 1 enter figure

,

,

,

,

.

.

0 0

0 0

from line 32, federal Form 1040 or line 17, 1040A.

F o r c o l u m n 2 s e e P I T - B i n s t r u c t i o n s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1

1 2 .

Total income (line 10 minus line 11); column 1

,

,

,

,

.

.

must be equal to or greater than Federal

0 0

0 0

Adjusted Gross Income (line 5, Form PIT-1.).12

,

1 3 .

Deduction for income which is nontaxable in

,

,

,

,

.

.

0 0

0 0

New Mexico (line 11 minus line 2 of

P I T - A D J F o r m . ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 3

1 4 .

SUBTRACT line 13 from line 12

,

,

,

,

.

.

0 0

0 0

a n d e n t e r a m o u n t h e r e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 4

1 5 .

DIVIDE amount on line 14, column 2 by amount on line14, column 1. Compute to 3 decimal places.

.

( C a n n o t b e l e s s t h a n z e r o o r g r e a t e r t h a n 1 0 0 % . ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 5

16. Using the Tax Rate Tables, find the tax applicable to line 10, Form PIT-1. If an amount is shown on

,

,

.

0 0

line 12, PIT-1, add this amount to the tax and enter the result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 6

,

,

.

1 7 .

MULTIPLY line 16 by line 15. Enter the amount here and on

0 0

l i n e 1 1 o f F o r m P I T - 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2