Print and Reset Form

Reset Form

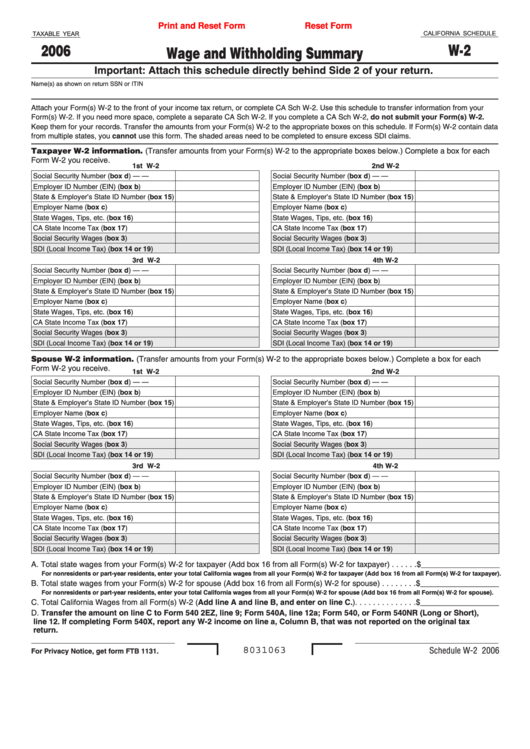

CALIFORNIA SCHEDULE

TAXABLE YEAR

W-2

2006

Wage and Withholding Summary

Important: Attach this schedule directly behind Side 2 of your return.

Name(s) as shown on return

SSN or ITIN

Attach your Form(s) W-2 to the front of your income tax return, or complete CA Sch W-2. Use this schedule to transfer information from your

Form(s) W-2. If you need more space, complete a separate CA Sch W-2. If you complete a CA Sch W-2, do not submit your Form(s) W‑2.

Keep them for your records. Transfer the amounts from your Form(s) W-2 to the appropriate boxes on this schedule. If Form(s) W-2 contain data

from multiple states, you cannot use this form. The shaded areas need to be completed to ensure excess SDI claims.

Taxpayer W-2 information. (Transfer amounts from your Form(s) W-2 to the appropriate boxes below.) Complete a box for each

Form W-2 you receive.

1st W‑2

2nd W‑2

Social Security Number (box d)

—

—

Social Security Number (box d)

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI (Local Income Tax) (box 14 or 19)

SDI (Local Income Tax) (box 14 or 19)

3rd W‑2

4th W‑2

Social Security Number (box d)

—

—

Social Security Number (box d)

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI (Local Income Tax) (box 14 or 19)

SDI (Local Income Tax) (box 14 or 19)

Spouse W-2 information. (Transfer amounts from your Form(s) W-2 to the appropriate boxes below.) Complete a box for each

Form W-2 you receive.

1st W‑2

2nd W‑2

Social Security Number (box d)

Social Security Number (box d)

—

—

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI (Local Income Tax) (box 14 or 19)

SDI (Local Income Tax) (box 14 or 19)

3rd W‑2

4th W‑2

Social Security Number (box d)

Social Security Number (box d)

—

—

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI (Local Income Tax) (box 14 or 19)

SDI (Local Income Tax) (box 14 or 19)

A. Total state wages from your Form(s) W-2 for taxpayer (Add box 16 from all Form(s) W-2 for taxpayer) . . . . . . $__________________

For nonresidents or part‑year residents, enter your total California wages from all your Form(s) W‑2 for taxpayer (Add box 16 from all Form(s) W‑2 for taxpayer).

B. Total state wages from your Form(s) W-2 for spouse (Add box 16 from all Form(s) W-2 for spouse) . . . . . . . . $__________________

For nonresidents or part‑year residents, enter your total California wages from all your Form(s) W‑2 for spouse (Add box 16 from all Form(s) W‑2 for spouse).

C. Total California Wages from all Form(s) W-2 (Add line A and line B, and enter on line C.). . . . . . . . . . . . . . $__________________

D. Transfer the amount on line C to Form 540 2EZ, line 9; Form 540A, line 12a; Form 540, or Form 540NR (Long or Short),

line 12. If completing Form 540X, report any W‑2 income on line a, Column B, that was not reported on the original tax

return.

8031063

Schedule W-2 2006

For Privacy Notice, get form FTB 1131.

1

1