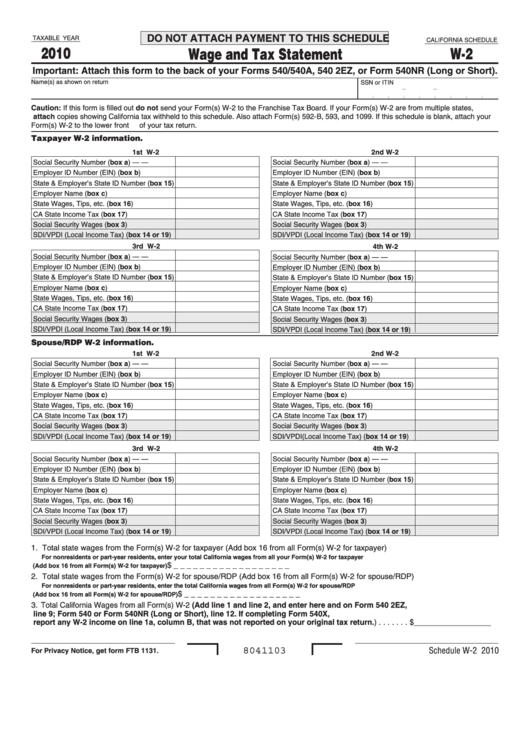

DO NOT ATTACH PAYMENT TO THIS SCHEDULE

TAXABLE YEAR

CALIFORNIA SCHEDULE

2010

Wage and Tax Statement

W-2

Important: Attach this form to the back of your Forms 540/540A, 540 2EZ, or Form 540NR (Long or Short).

Name(s) as shown on return

SSN or ITIN

-

-

Caution: If this form is filled out do not send your Form(s) W-2 to the Franchise Tax Board. If your Form(s) W-2 are from multiple states,

a ttach copies showing California tax withheld to this schedule. Also attach Form(s) 592-B, 593, and 1099. If this schedule is blank, attach your

Form(s) W-2 to the lower front of your tax return.

Taxpayer W-2 information.

1st W-2

2nd W-2

Social Security Number (box a)

Social Security Number (box a)

—

—

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI/VPDI (Local Income Tax) (box 14 or 19)

SDI/VPDI (Local Income Tax) (box 14 or 19)

3rd W-2

4th W-2

Social Security Number (box a)

—

—

Social Security Number (box a)

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI/VPDI (Local Income Tax) (box 14 or 19)

SDI/VPDI (Local Income Tax) (box 14 or 19)

Spouse/RDP W-2 information.

1st W-2

2nd W-2

Social Security Number (box a)

—

—

Social Security Number (box a)

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI/VPDI (Local Income Tax) (box 14 or 19)

SDI/VPDI(Local Income Tax) (box 14 or 19)

3rd W-2

4th W-2

Social Security Number (box a)

—

—

Social Security Number (box a)

—

—

Employer ID Number (EIN) (box b)

Employer ID Number (EIN) (box b)

State & Employer’s State ID Number (box 15)

State & Employer’s State ID Number (box 15)

Employer Name (box c)

Employer Name (box c)

State Wages, Tips, etc. (box 16)

State Wages, Tips, etc. (box 16)

CA State Income Tax (box 17)

CA State Income Tax (box 17)

Social Security Wages (box 3)

Social Security Wages (box 3)

SDI/VPDI (Local Income Tax) (box 14 or 19)

SDI/VPDI (Local Income Tax) (box 14 or 19)

1. Total state wages from the Form(s) W-2 for taxpayer (Add box 16 from all Form(s) W-2 for taxpayer)

For nonresidents or part-year residents, enter your total California wages from all your Form(s) W-2 for taxpayer

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $__________________

(Add box 16 from all Form(s) W-2 for taxpayer)

2. Total state wages from the Form(s) W-2 for spouse/RDP (Add box 16 from all Form(s) W-2 for spouse/RDP)

For nonresidents or part-year residents, enter the total California wages from all Form(s) W-2 for spouse/RDP

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $__________________

(Add box 16 from all Form(s) W-2 for spouse/RDP)

3. Total California Wages from all Form(s) W-2 (Add line 1 and line 2, and enter here and on Form 540 2EZ,

line 9; Form 540 or Form 540NR (Long or Short), line 12. If completing Form 540X,

report any W-2 income on line 1a, column B, that was not reported on your original tax return.) . . . . . . . $__________________

Schedule W-2 2010

8041103

For Privacy Notice, get form FTB 1131.

1

1