Form K-Cns 010 - Employer Status Report - Kansas Department Of Labor Page 3

ADVERTISEMENT

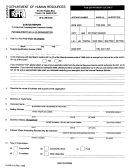

KANSAS DEPARTMENT OF LABOR

Page 3 of 4

K-CNS 010 (Rev. 09-10)

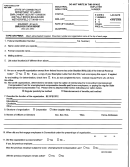

17. In which WEEK did you establish liability based on the number of weeks of employment?

(Please indicate the week in which you established liability. Note: Refer to instructions for more detail.)

Yes

No

18. Did you acquire / purchase All or Part of an existing business?

18a. Date acquired / purchased:

All

Part

% acquired

M

M

D

D

Y

Y

Y

Y

Yes

No

18b. Is the prior owner continuing business in Kansas?

If yes, explain below:

Yes

No

18c. Do you wish to accept the prior owner's Unemployment Tax Rate?

Prior owner's Kansas

18d. Name of prior owner:

Employer Serial Number:

18e. Prior business or

Current phone

trade name:

number:

18f. Prior owner's current address:

Street Number/PO Box

Direction

Street Name

Apt/Suite No

City

State

Zip + 4

K.S.A. 44-7710a(b)(2) allows a successor, defined in K.S.A. 44-703(h)(4) and K.S.A. 44-703(dd), the choice to acquire the experience rating factors of the

predecessor employer. The request for transfer must be made in writing within 120 days of the acquisition. The experience rating factors are all of the

unemployment taxes paid, annual payrolls and benefit charges of the predecessor employer. These factors are used to compute your unemployment tax rate for

subsequent years. Alternately, successor employers may elect to be assigned their industry tax rate.

No multiple locations

19. For the last three years, list any multiple business locations you have operated in KANSAS

Trade Name and Address

Date Opened

Date Closed

Number of Employees

Business Activity

20. Are you subject to the Federal Unemployment Tax Act (FUTA)?

Current Year

Yes

No

Prior Year

Yes

No

21. If no liability is indicated, do you wish to elect coverage?

Yes, beginning January 1 of the current year, or at the commencement of employment, and continuing for not less than two calendar

years, on behalf of the employing unit, I voluntarily elect to: (select one or both)

to become an employer described in K.S.A. 44-703(h), the same as other employers, even though no mandatory coverage is indicated

to extend coverage to all workers performing services that are excluded from coverage as described in K.S.A. 44-703(i)

No

Yes

No

22. Are you continuing to pay wages in KANSAS?

Yes

No

23. Do you have individuals performing services you believe are not employees?

If yes, explain below. Attach additional pages if necessary.

24. Would you like to have a KDOL representative contact you directly to provide additional information on exemptions, payment

options for governmental/political sub-divisions or 501(C)(3) entities, successorship or any other status report information?

Yes

No

25. I certify that the information I have provided on this report is complete, correct and true to the best of my knowledge and belief.

Date

Signed

M

M

D

D

Y

Y

Y

Y

Signature of owner, partner, member/manager, corporate officer, etc.

Title - owner, partner, m/m, corporate

officer, etc.

The information requested in this report is required to be provided by K.S.A. 44-714(f) and K.A.R. 50-2-5. It will be used only by

public officials in the performance of their public duties. Section 6103(d) of the Internal Revenue Code authorizes IRS to

UNEMPLOYMENT INSURANCE CONTRIBUTIONS

exchange information with us for audits and certifications.

P.O. Box 400, Topeka, KS • phone (785) 296-5027 • fax (785) 291-3425

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3