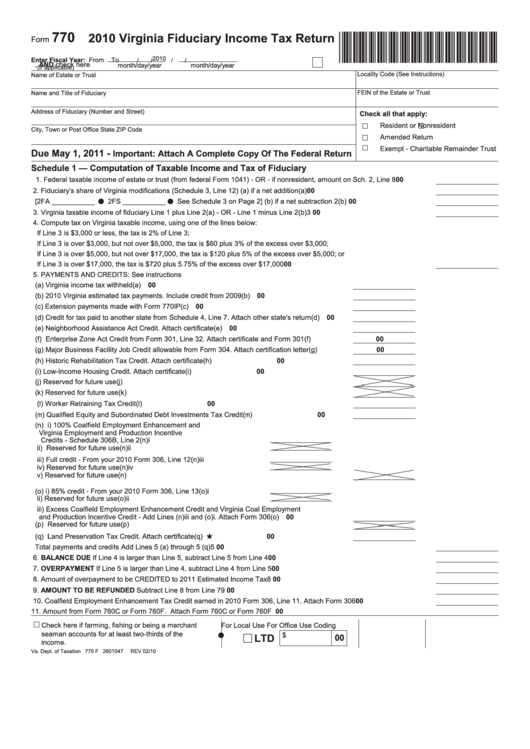

Form 770 - Virginia Fiduciary Income Tax Return - 2010

ADVERTISEMENT

770

2010 Virginia Fiduciary Income Tax Return

*VA0770110000*

Form

2010

Enter Fiscal Year: From

To

/

/

/

/

, AND check here

month/day/year

month/day/year

(if applicable)

Locality Code (See Instructions)

Name of Estate or Trust

FEIN of the Estate or Trust

Name and Title of Fiduciary

Address of Fiduciary (Number and Street)

Check all that apply:

Resident or

Nonresident

City, Town or Post Office

State

ZIP Code

Amended Return

Exempt - Charitable Remainder Trust

Due May 1, 2011 -

Important: Attach A Complete Copy Of The Federal Return

Schedule 1 — Computation of Taxable Income and Tax of Fiduciary

1. Federal taxable income of estate or trust (from federal Form 1041) - OR - if nonresident, amount on Sch. 2, Line 8 ..................1

00

2. Fiduciary’s share of Virginia modifications (Schedule 3, Line 12)

(a) if a net addition ................ 2(a)

00

00

[2FA ___________ v 2FS ___________ v See Schedule 3 on Page 2]

(b) if a net subtraction ........... 2(b)

3. Virginia taxable income of fiduciary Line 1 plus Line 2(a) - OR - Line 1 minus Line 2(b) ..............................................................3

00

4. Compute tax on Virginia taxable income, using one of the lines below:

If Line 3 is $3,000 or less, the tax is 2% of Line 3;

If Line 3 is over $3,000, but not over $5,000, the tax is $60 plus 3% of the excess over $3,000;

If Line 3 is over $5,000, but not over $17,000, the tax is $120 plus 5% of the excess over $5,000; or

If Line 3 is over $17,000, the tax is $720 plus 5.75% of the excess over $17,000 ..................................................................4

00

5. PAYMENTS AND CREDITS: See instructions

(a) Virginia income tax withheld .................................................................................................(a)

00

00

(b) 2010 Virginia estimated tax payments. Include credit from 2009 .........................................(b)

(c) Extension payments made with Form 770IP ........................................................................ (c)

00

(d) Credit for tax paid to another state from Schedule 4, Line 7. Attach other state's return ......(d)

00

(e) Neighborhood Assistance Act Credit. Attach certificate ........................................................(e)

00

(f) Enterprise Zone Act Credit from Form 301, Line 32. Attach certificate and Form 301 ...........(f)

00

(g) Major Business Facility Job Credit allowable from Form 304. Attach certification letter .......(g)

00

(h) Historic Rehabilitation Tax Credit. Attach certificate ..............................................................(h)

00

(i) Low-Income Housing Credit. Attach certificate ...................................................................... (i)

00

(j) Reserved for future use ......................................................................................................... (j)

(k) Reserved for future use ......................................................................................................... (k)

(l) Worker Retraining Tax Credit ................................................................................................. (l)

00

(m) Qualified Equity and Subordinated Debt Investments Tax Credit ........................................ (m)

00

(n) i) 100% Coalfield Employment Enhancement and

Virginia Employment and Production Incentive

Credits - Schedule 306B, Line 2............................................(n)i

ii) Reserved for future use ........................................................ (n)ii

iii) Full credit - From your 2010 Form 306, Line 12 ................... (n)iii

iv) Reserved for future use ........................................................ (n)iv

v) Reserved for future use ......................................................................................................(n)

(o) i) 85% credit - From your 2010 Form 306, Line 13.................... (o)i

ii) Reserved for future use ......................................................... (o)ii

iii) Excess Coalfield Employment Enhancement Credit and Virginia Coal Employment

and Production Incentive Credit - Add Lines (n)iii and (o)i. Attach Form 306 ......................(o)

00

(p) Reserved for future use .........................................................................................................(p)

(q) Land Preservation Tax Credit. Attach certificate ....................................................................(q)

00

.

Total payments and credits Add Lines 5 (a) through 5 (q) .............................................................................................................5

00

6. BALANCE DUE If Line 4 is larger than Line 5, subtract Line 5 from Line 4 .................................................................................6

00

7. OVERPAYMENT If Line 5 is larger than Line 4, subtract Line 4 from Line 5 ................................................................................7

00

8. Amount of overpayment to be CREDITED to 2011 Estimated Income Tax ...................................................................................8

00

9. AMOUNT TO BE REFUNDED Subtract Line 8 from Line 7..........................................................................................................9

00

10. Coalfield Employment Enhancement Tax Credit earned in 2010 Form 306, Line 11. Attach Form 306 ......................................10

00

11. Amount from Form 760C or Form 760F. Attach Form 760C or Form 760F ................................................................................ 11

00

Check here if farming, fishing or being a merchant

For Local Use

For Office Use

Coding

seaman accounts for at least two-thirds of the

$

LTD

v

00

j

income.

Va. Dept. of Taxation 770 F 2601047

REV 02/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3