Form 770 - Virginia Fiduciary Income Tax Return - 1999

ADVERTISEMENT

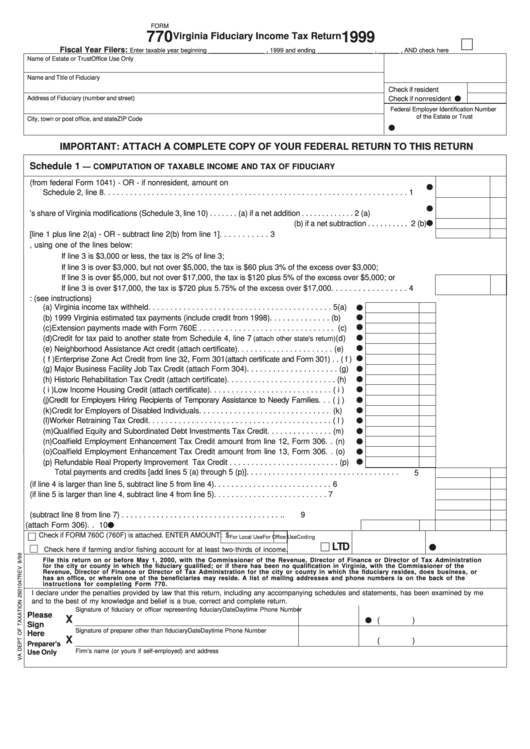

FORM

770

1999

Virginia Fiduciary Income Tax Return

Fiscal Year Filers:

Enter taxable year beginning

, 1999 and ending

,

, AND check here

___________________

___________________

_______

Name of Estate or Trust

Office Use Only

Name and Title of Fiduciary

Check if resident

Address of Fiduciary (number and street)

Check if nonresident

Federal Employer Identification Number

of the Estate or Trust

City, town or post office, and state

ZIP Code

IMPORTANT: ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN TO THIS RETURN

Schedule 1

— COMPUTATION OF TAXABLE INCOME AND TAX OF FIDUCIARY

1. Federal taxable income of the estate or trust (from federal Form 1041) - OR - if nonresident, amount on

Schedule 2, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Fiduciary’s share of Virginia modifications (Schedule 3, line 10) . . . . . . . (a) if a net addition . . . . . . . . . . . . . 2 (a)

(b) if a net subtraction . . . . . . . . . . 2 (b)

3. Virginia taxable income of fiduciary [line 1 plus line 2(a) - OR - subtract line 2(b) from line 1] . . . . . . . . . . .

3

4. Compute tax on Virginia taxable income, using one of the lines below:

If line 3 is $3,000 or less, the tax is 2% of line 3;

If line 3 is over $3,000, but not over $5,000, the tax is $60 plus 3% of the excess over $3,000;

If line 3 is over $5,000, but not over $17,000, the tax is $120 plus 5% of the excess over $5,000; or

If line 3 is over $17,000, the tax is $720 plus 5.75% of the excess over $17,000 . . . . . . . . . . . . . . . . .

4

5. PAYMENTS AND CREDITS: (see instructions)

(a) Virginia income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5(a)

(b) 1999 Virginia estimated tax payments (include credit from 1998) . . . . . . . . . . . . . . (b)

(c) Extension payments made with Form 760E . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (c)

(d) Credit for tax paid to another state from Schedule 4, line 7

(d)

(attach other state's return)

(e) Neighborhood Assistance Act credit (attach certificate) . . . . . . . . . . . . . . . . . . . . . . (e)

( f ) Enterprise Zone Act Credit from line 32, Form 301(attach certificate and Form 301) . . ( f )

(g) Major Business Facility Job Tax Credit (attach Form 304) . . . . . . . . . . . . . . . . . . . . . (g)

(h) Historic Rehabilitation Tax Credit (attach certificate) . . . . . . . . . . . . . . . . . . . . . . . . . (h)

( i ) Low Income Housing Credit (attach certificate) . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( i )

(j) Credit for Employers Hiring Recipients of Temporary Assistance to Needy Families . . . ( j )

(k) Credit for Employers of Disabled Individuals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (k)

(l) Worker Retraining Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ( l )

( ) Qualified Equity and Subordinated Debt Investments Tax Credit . . . . . . . . . . . . . . . ( )

(n) Coalfield Employment Enhancement Tax Credit amount from line 12, Form 306 . . (n)

(o) Coalfield Employment Enhancement Tax Credit amount from line 13, Form 306 . . (o)

(p) Refundable Real Property Improvement Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . (p)

Total payments and credits [add lines 5 (a) through 5 (p)] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. BALANCE DUE (if line 4 is larger than line 5, subtract line 5 from line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7. OVERPAYMENT (if line 5 is larger than line 4, subtract line 4 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8. Amount of overpayment to be CREDITED to 2000 ESTIMATED income tax . . . . . . . . . . . . . . . . . . . . . . . . .

8

9. AMOUNT TO BE REFUNDED (subtract line 8 from line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Coalfield employment enhancement tax credit earned in 1999 (attach Form 306) . . 10

Check if FORM 760C (760F) is attached. ENTER AMOUNT: $

For Local Use

For Office Use

Coding

LTD

Check here if farming and/or fishing account for at least two-thirds of income.

File this return on or before May 1, 2000, with the Commissioner of the Revenue, Director of Finance or Director of Tax Administration

for the city or county in which the fiduciary qualified; or if there has been no qualification in Virginia, with the Commissioner of the

Revenue, Director of Finance or Director of Tax Administration for the city or county in which the fiduciary resides, does business, or

has an office, or wherein one of the beneficiaries may reside. A list of mailing addresses and phone numbers is on the back of the

instructions for completing Form 770.

I declare under the penalties provided by law that this return, including any accompanying schedules and statements, has been examined by me

and to the best of my knowledge and belief is a true, correct and complete return.

Signature of fiduciary or officer representing fiduciary

Date

Daytime Phone Number

Please

X

(

)

Sign

Signature of preparer other than fiduciary

Date

Daytime Phone Number

Here

X

(

)

Preparer's

Firm’s name (or yours if self-employed) and address

Use Only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2