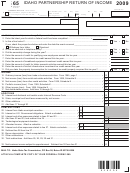

Form 65 - Idaho Partnership Return Of Income - 2005 Page 2

ADVERTISEMENT

Form 65

TC6505p2

9-06-2005

Page 2

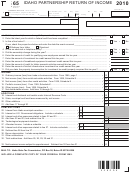

34

34.

Net business income subject to apportionment. Enter the amount from line 33. ........................................

35.

Partnerships with all activity in Idaho enter 100%. Multistate/multinational partnerships complete and

.

%

35

attach Form 42. Enter the apportionment factor from Form 42, Part I, line 21. ......................................

.

36

36.

Net business income apportioned to Idaho. Multiply line 34 by the percent on line 35. ..............................

.

37

37.

Income allocated to Idaho. See instructions. .............................................................................................

.

38

38.

Idaho compensation of individual partners not reported to Idaho ...............................................................

.

39

39.

Partnership income reported to Idaho on the partners' income tax returns .................................................

.

40.

Idaho taxable income. Add lines 36 through 38, and subtract line 39.

40

TAX COMPUTATION

.

41. Idaho income tax. Multiply line 40 by 7.6%.

41

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

42.

Credit for contributions to Idaho educational entities ..................................

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

42

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

43.

Credit for contributions to Idaho youth and rehabilitation facilities .............

43

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

44.

Total business income tax credits from Form 44, Part I, line 14.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

Attach Form 44. .............................................................................................

44

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

45.

Total credits. Add lines 42 through 44. .....................................................................................................

45

46.

Subtract line 45 from line 41. If line 45 is greater than line 41, enter zero.

46

.

OTHER TAXES

47

47.

Permanent building fund tax. See instructions. ......................................................................................

48

48.

Total tax from recapture of income tax credits from Form 44, Part II, line 10. Attach Form 44. ...............

49

49.

.

Fuels tax due. Attach Form 75. ................................................................................................................

50

50.

Sales/Use tax due on mail order, Internet, and other nontaxed purchases ............................................

.

51

51.

Tax from recapture of qualified investment exemption (QIE). Attach Form 49ER. ...................................

.

52.

Total tax. Add lines 46 through 51.

52

PAYMENTS and OTHER CREDITS

.

53

53.

Estimated tax payments ...........................................................................................................................

54.

Special fuels tax refund ______________ Gasoline tax refund __________________ Attach Form 75.

54

55.

Total payments and other credits. Add line 53 and line 54.

55

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

If line 52 is more than line 55, GO TO LINE 56. If line 52 is less than line 55, GO TO LINE 59.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

REFUND or PAYMENT DUE

.

56

56.

Tax Due. Subtract line 55 from line 52. ....................................................................................................

.

.

57.

Penalty

_______________________ Interest from due date

_____________________ Enter total.

57

.

58

58.

TOTAL DUE. Add line 56 and line 57. ......................................................................................................

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

59.

Overpayment. Subtract line 52 from line 55. ................................................

59

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

60.

REFUND. Amount of line 59 you want refunded to you. ...............................

60

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

61.

ESTIMATED TAX. Amount you want credited to your 2006 estimated tax. Subtract line 60 from line 59.

61

AMENDED RETURN ONLY.

Complete this section to determine your tax due or refund.

62.

62

Total tax due (line 58) or overpayment (line 59) on this return ................................................................

63.

Refund from original return plus additional refunds ...............................................................................

63

64.

Tax paid with original return plus additional tax paid ...............................................................................

64

65.

65

Amended tax due or refund. Add lines 62 and 63, and subtract line 64.

.

Within 180 days of receiving this return, the Idaho State Tax Commission may discuss this return with the paid preparer identified below.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete.

Signature of officer

Date

Paid preparer's signature

Preparer's EIN, SSN, or PTIN

.

.

.

SIGN

HERE

Title

Phone number

Address and phone number

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

ATTACH A COMPLETE COPY OF YOUR FEDERAL FORM 1065

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2