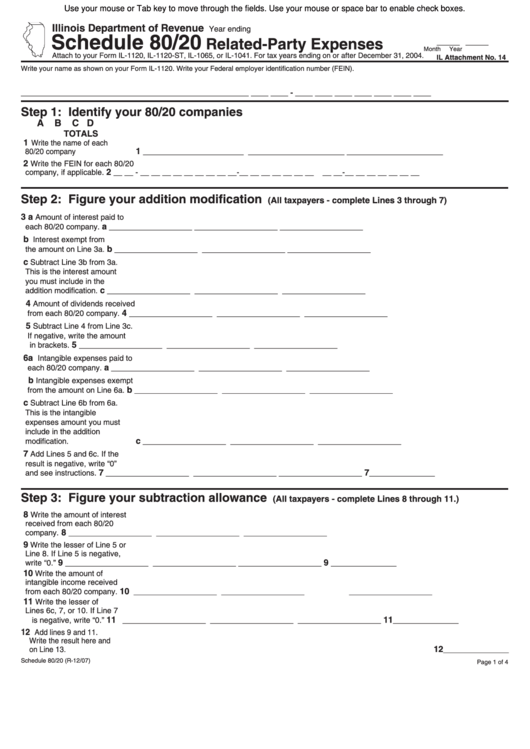

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Year ending

Schedule 80/20

Related-Party Expenses

____ ____

Month

Year

Attach to your Form IL-��20, IL-��20-ST, IL-�065, or IL-�04�. For tax years ending on or after December 3�, 2004.

IL Attachment No. 14

Write your name as shown on your Form IL-��20.

Write your Federal employer identification number (FEIN).

____________________________________________________

____ ____ - ____ ____ ____ ____ ____ ____ ____

Step 1: Identify your 80/20 companies

A

B

C

D

TOTALS

1

Write the name of each

1

80/20 company

_______________________ ______________________

______________________

2

Write the FEIN for each 80/20

2

company, if applicable.

__ __ - __ __ __ __ __ __ __ __ __-__ __ __ __ __ __ __

__ __-__ __ __ __ __ __ __

Step 2: Figure your addition modification

(All taxpayers - complete Lines 3 through 7)

3 a

Amount of interest paid to

a

each 80/20 company.

___________________

___________________

___________________

b

Interest exempt from

b

the amount on Line 3a.

___________________

___________________

___________________

c

Subtract Line 3b from 3a.

This is the interest amount

you must include in the

c

addition modification.

___________________

___________________

___________________

4

Amount of dividends received

4

from each 80/20 company.

___________________

___________________

___________________

5

Subtract Line 4 from Line 3c.

If negative, write the amount

5

in brackets.

___________________

___________________

___________________

6a

Intangible expenses paid to

a

each 80/20 company.

___________________

___________________

___________________

b

Intangible expenses exempt

b

from the amount on Line 6a.

___________________

___________________

___________________

c

Subtract Line 6b from 6a.

This is the intangible

expenses amount you must

include in the addition

c

modification.

___________________

___________________

___________________

7

Add Lines 5 and 6c. If the

result is negative, write “0”

7

7

and see instructions.

___________________

___________________

___________________

_______________

Step 3: Figure your subtraction allowance

(All taxpayers - complete Lines 8 through 11.)

8

Write the amount of interest

received from each 80/20

8

company.

___________________

___________________

___________________

9

Write the lesser of Line 5 or

Line 8. If Line 5 is negative,

9

9

write “0.”

___________________

___________________

___________________

_______________

10

Write the amount of

intangible income received

10

from each 80/20 company.

___________________

___________________

___________________

11

Write the lesser of

Lines 6c, 7, or �0. If Line 7

11

11

_______________

is negative, write “0.”

___________________

___________________

___________________

12

Add lines 9 and ��.

Write the result here and

12

_______________

on Line �3.

Schedule 80/20 (R-�2/07)

Page � of 4

1

1 2

2