Instructions For Pa Schedule F Farm Income And Expenses Form Pa-40 F 2008

ADVERTISEMENT

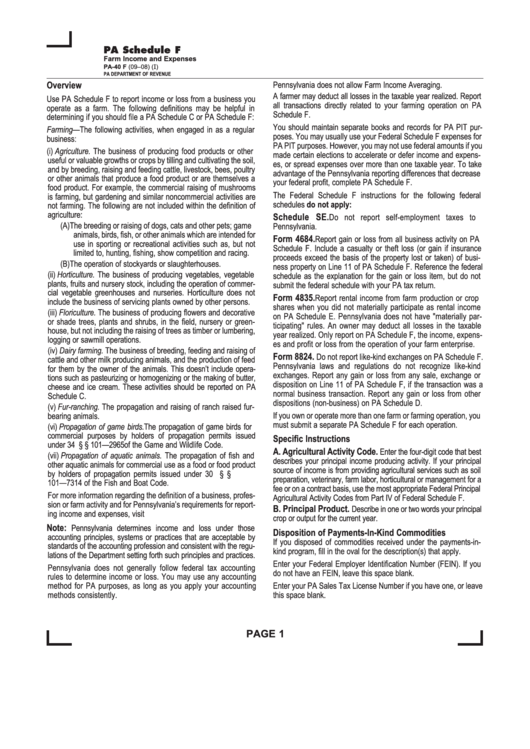

PA Schedule F

Farm Income and Expenses

PA-40 F (09–08) (I)

PA DEPARTMENT OF REVENUE

Overview

Pennsylvania does not allow Farm Income Averaging.

A farmer may deduct all losses in the taxable year realized. Report

Use PA Schedule F to report income or loss from a business you

all transactions directly related to your farming operation on PA

operate as a farm. The following definitions may be helpful in

Schedule F.

determining if you should file a PA Schedule C or PA Schedule F:

You should maintain separate books and records for PA PIT pur-

Farming—The following activities, when engaged in as a regular

poses. You may usually use your Federal Schedule F expenses for

business:

PA PIT purposes. However, you may not use federal amounts if you

(i) Agriculture. The business of producing food products or other

made certain elections to accelerate or defer income and expens-

useful or valuable growths or crops by tilling and cultivating the soil,

es, or spread expenses over more than one taxable year. To take

and by breeding, raising and feeding cattle, livestock, bees, poultry

advantage of the Pennsylvania reporting differences that decrease

or other animals that produce a food product or are themselves a

your federal profit, complete PA Schedule F.

food product. For example, the commercial raising of mushrooms

The Federal Schedule F instructions for the following federal

is farming, but gardening and similar noncommercial activities are

schedules do not apply:

not farming. The following are not included within the definition of

agriculture:

Schedule SE.

Do not report self-employment taxes to

(A) The breeding or raising of dogs, cats and other pets; game

Pennsylvania.

animals, birds, fish, or other animals which are intended for

Form 4684.

Report gain or loss from all business activity on PA

use in sporting or recreational activities such as, but not

Schedule F. Include a casualty or theft loss (or gain if insurance

limited to, hunting, fishing, show competition and racing.

proceeds exceed the basis of the property lost or taken) of busi-

(B) The operation of stockyards or slaughterhouses.

ness property on Line 11 of PA Schedule F. Reference the federal

(ii) Horticulture. The business of producing vegetables, vegetable

schedule as the explanation for the gain or loss item, but do not

plants, fruits and nursery stock, including the operation of commer-

submit the federal schedule with your PA tax return.

cial vegetable greenhouses and nurseries. Horticulture does not

Form 4835.

Report rental income from farm production or crop

include the business of servicing plants owned by other persons.

shares when you did not materially participate as rental income

(iii) Floriculture. The business of producing flowers and decorative

on PA Schedule E. Pennsylvania does not have "materially par-

or shade trees, plants and shrubs, in the field, nursery or green-

ticipating" rules. An owner may deduct all losses in the taxable

house, but not including the raising of trees as timber or lumbering,

year realized. Only report on PA Schedule F, the income, expens-

logging or sawmill operations.

es and profit or loss from the operation of your farm enterprise.

(iv) Dairy farming. The business of breeding, feeding and raising of

Form 8824.

Do not report like-kind exchanges on PA Schedule F.

cattle and other milk producing animals, and the production of feed

Pennsylvania laws and regulations do not recognize like-kind

for them by the owner of the animals. This doesn’t include opera-

exchanges. Report any gain or loss from any sale, exchange or

tions such as pasteurizing or homogenizing or the making of butter,

disposition on Line 11 of PA Schedule F, if the transaction was a

cheese and ice cream. These activities should be reported on PA

normal business transaction. Report any gain or loss from other

Schedule C.

dispositions (non-business) on PA Schedule D.

(v) Fur-ranching. The propagation and raising of ranch raised fur-

If you own or operate more than one farm or farming operation, you

bearing animals.

must submit a separate PA Schedule F for each operation.

(vi) Propagation of game birds. The propagation of game birds for

commercial purposes by holders of propagation permits issued

Specific Instructions

under 34 Pa.C.S. § § 101—2965 of the Game and Wildlife Code.

A. Agricultural Activity Code.

Enter the four-digit code that best

(vii) Propagation of aquatic animals. The propagation of fish and

describes your principal income producing activity. If your principal

other aquatic animals for commercial use as a food or food product

source of income is from providing agricultural services such as soil

by holders of propagation permits issued under 30 Pa.C.S. § §

preparation, veterinary, farm labor, horticultural or management for a

101—7314 of the Fish and Boat Code.

fee or on a contract basis, use the most appropriate Federal Principal

For more information regarding the definition of a business, profes-

Agricultural Activity Codes from Part IV of Federal Schedule F.

sion or farm activity and for Pennsylvania’s requirements for report-

B. Principal Product.

Describe in one or two words your principal

ing income and expenses, visit

crop or output for the current year.

Note:

Pennsylvania determines income and loss under those

Disposition of Payments-In-Kind Commodities

accounting principles, systems or practices that are acceptable by

If you disposed of commodities received under the payments-in-

standards of the accounting profession and consistent with the regu-

kind program, fill in the oval for the description(s) that apply.

lations of the Department setting forth such principles and practices.

Enter your Federal Employer Identification Number (FEIN). If you

Pennsylvania does not generally follow federal tax accounting

do not have an FEIN, leave this space blank.

rules to determine income or loss. You may use any accounting

method for PA purposes, as long as you apply your accounting

Enter your PA Sales Tax License Number if you have one, or leave

methods consistently.

this space blank.

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2