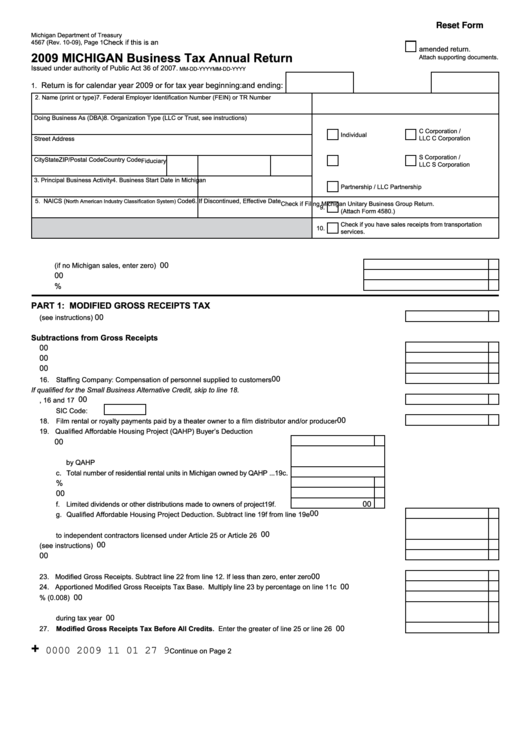

Reset Form

Michigan Department of Treasury

Check if this is an

4567 (Rev. 10-09), Page 1

amended return.

2009 MICHIGAN Business Tax Annual Return

.

Attach supporting documents

Issued under authority of Public Act 36 of 2007.

MM-DD-YYYY

MM-DD-YYYY

Return is for calendar year 2009 or for tax year beginning:

and ending:

1.

2. Name (print or type)

7. Federal Employer Identification Number (FEIN) or TR Number

Doing Business As (DBA)

8. Organization Type (LLC or Trust, see instructions)

C Corporation /

Individual

LLC C Corporation

Street Address

S Corporation /

City

State

ZIP/Postal Code

Country Code

Fiduciary

LLC S Corporation

3. Principal Business Activity

4. Business Start Date in Michigan

Partnership / LLC Partnership

5. NAICS (

Code

6. If Discontinued, Effective Date

North American Industry Classification System)

Check if Filing Michigan Unitary Business Group Return.

9.

(Attach Form 4580.)

Check if you have sales receipts from transportation

10.

services.

11.

Apportionment Calculation

00

a. Michigan Sales (if no Michigan sales, enter zero) .................................................................

11a.

00

b. Total Sales .............................................................................................................................

11b.

%

c. Apportionment Percentage. Divide line 11a by line 11b ........................................................

11c.

PART 1: MODIFIED GROSS RECEIPTS TAX

00

12. Gross Receipts (see instructions)......................................................................................................................

12.

Subtractions from Gross Receipts

00

13. Inventory acquired during tax year ....................................................................................................................

13.

00

14. Depreciable assets acquired during tax year ....................................................................................................

14.

00

15. Materials and supplies not included in inventory or depreciable property .........................................................

15.

00

16. Staffing Company: Compensation of personnel supplied to customers ............................................................

16.

If qualified for the Small Business Alternative Credit, skip to line 18.

00

17. Deduction for contractors in SIC Codes 15, 16 and 17 .....................................................................................

17.

SIC Code:

00

18. Film rental or royalty payments paid by a theater owner to a film distributor and/or producer ..........................

18.

19. Qualified Affordable Housing Project (QAHP) Buyer’s Deduction

00

a. Gross receipts attributable to residential rentals in Michigan ........... 19a.

b. Number of residential rent restricted units in Michigan owned

by QAHP ........................................................................................... 19b.

c. Total number of residential rental units in Michigan owned by QAHP ... 19c.

%

d. Divide line 19b by line 19c and enter as a percentage .................... 19d.

00

e. Multiply line 19a by line 19d ............................................................. 19e.

00

f. Limited dividends or other distributions made to owners of project .... 19f.

00

g. Qualified Affordable Housing Project Deduction. Subtract line 19f from line 19e ........................................ 19g.

20. Payments made by taxpayers licensed under Article 25 or Article 26 of the Occupational Code

00

to independent contractors licensed under Article 25 or Article 26 ....................................................................

20.

00

21. Miscellaneous (see instructions) .......................................................................................................................

21.

00

22. Total Subtractions from Gross Receipts. Add lines 13 through 18 and 19g through 21 ....................................

22.

00

23. Modified Gross Receipts. Subtract line 22 from line 12. If less than zero, enter zero .......................................

23.

00

24. Apportioned Modified Gross Receipts Tax Base. Multiply line 23 by percentage on line 11c ..........................

24.

00

25. Multiply line 24 by 0.8% (0.008) .......................................................................................................................

25.

26. Enrichment Prohibition for dealers of personal watercraft or new motor vehicles. Enter amount collected

00

during tax year ...................................................................................................................................................

26.

00

27. Modified Gross Receipts Tax Before All Credits. Enter the greater of line 25 or line 26 .............................

27.

+

0000 2009 11 01 27 9

Continue on Page 2

1

1 2

2 3

3