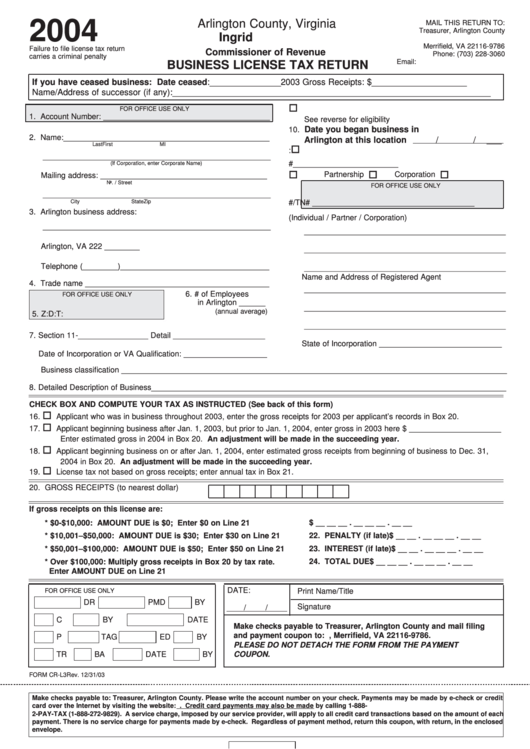

Business License Tax Return Form - Virginia Commissioner Of Revenue - 2004

ADVERTISEMENT

2004

Arlington County, Virginia

MAIL THIS RETURN TO:

Treasurer, Arlington County

Ingrid H. Morroy

P.O. Box 1757

Merrifield, VA 22116-9786

Failure to file license tax return

Commissioner of Revenue

Phone: (703) 228-3060

carries a criminal penalty

Email: revenue@co.arlington.va.us

BUSINESS LICENSE TAX RETURN

If you have ceased business: Date ceased: _______________

2003 Gross Receipts: $ ____________________

Name/Address of successor (if any): ___________________________________________________________________

9.

Businesses using installment payment

Check Here

FOR OFFICE USE ONLY

1. Account Number: ______________________________________

See reverse for eligibility

Date you began business in

10.

2. Name: _______________________________________________

Arlington at this location

/

/

___

Last

First

MI

11. Check here if Arlington business is residence:

____________________________________________________

12. Federal EIN or Soc. Sec. # ________________________

(If Corporation, enter Corporate Name)

13. Individual

Partnership

Corporation

Mailing address: ______________________________________

No. / Street

FOR OFFICE USE ONLY

____________________________________________________

City

State

Zip

14. CO #/TN# _____________________________________

3. Arlington business address:

15. Home Address (Individual / Partner / Corporation)

____________________________________________________

______________________________________________

Arlington, VA 222 ________

______________________________________________

Telephone (________)__________________________________

______________________________________________

Name and Address of Registered Agent

4. Trade name __________________________________________

______________________________________________

6. # of Employees

FOR OFFICE USE ONLY

in Arlington ______

______________________________________________

(annual average)

5. Z:

D:

T:

______________________________________________

7. Section 11- ________________ Detail _____________________

State of Incorporation ____________________________

Date of Incorporation or VA Qualification: ___________________

Business classification ________________________________________________________________________________________

8. Detailed Description of Business _________________________________________________________________________________

CHECK BOX AND COMPUTE YOUR TAX AS INSTRUCTED (See back of this form)

16.

Applicant who was in business throughout 2003, enter the gross receipts for 2003 per applicant’s records in Box 20.

17.

Applicant beginning business after Jan. 1, 2003, but prior to Jan. 1, 2004, enter gross in 2003 here $ _____________________

Enter estimated gross in 2004 in Box 20. An adjustment will be made in the succeeding year.

18.

Applicant beginning business on or after Jan. 1, 2004, enter estimated gross receipts from beginning of business to Dec. 31,

2004 in Box 20. An adjustment will be made in the succeeding year.

19.

License tax not based on gross receipts; enter annual tax in Box 21.

20. GROSS RECEIPTS (to nearest dollar)

If gross receipts on this license are:

* $0-$10,000: AMOUNT DUE is $0; Enter $0 on Line 21

21. AMOUNT DUE

$ __ __ __ . __ __ __ . __ __

* $10,001–$50,000: AMOUNT DUE is $30; Enter $30 on Line 21

22. PENALTY (if late)

$ __ __ . __ __ __ . __ __

23. INTEREST (if late)

$ __ __ . __ __ __ . __ __

* $50,001–$100,000: AMOUNT DUE is $50; Enter $50 on Line 21

* Over $100,000: Multiply gross receipts in Box 20 by tax rate.

24. TOTAL DUE

$ __ __ __ . __ __ __ . __ __

Enter AMOUNT DUE on Line 21

DATE:

Print Name/Title

FOR OFFICE USE ONLY

DR

PMD

BY

Signature

/

/

C

BY

DATE

Make checks payable to Treasurer, Arlington County and mail filing

and payment coupon to: P.O. Box 1757, Merrifield, VA 22116-9786.

P

TAG

ED

BY

PLEASE DO NOT DETACH THE FORM FROM THE PAYMENT

TR

BA

DATE

BY

COUPON.

FORM CR-L3 Rev. 12/31/03

Make checks payable to: Treasurer, Arlington County. Please write the account number on your check. Payments may be made by e-check or credit

card over the Internet by visiting the website: Credit card payments may also be made by calling 1-888-

2-PAY-TAX (1-888-272-9829). A service charge, imposed by our service provider, will apply to all credit card transactions based on the amount of each

payment. There is no service charge for payments made by e-check. Regardless of payment method, return this coupon, with return, in the enclosed

envelope.

Contact Person: ___________________________

BL

METHOD OF REMITTANCE:

_____ CHECK

_____ (PHONE) CREDIT CARD

Telephone: _______________________________

Due Date

_____ INTERNET (E-CHECK OR CREDIT CARD)

March 1, 2004

TOTAL AMOUNT REMITTED

$

Email Address: ____________________________

Account #22

Please check here if you would like to receive

“Commissioner’s Alerts” by email.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1