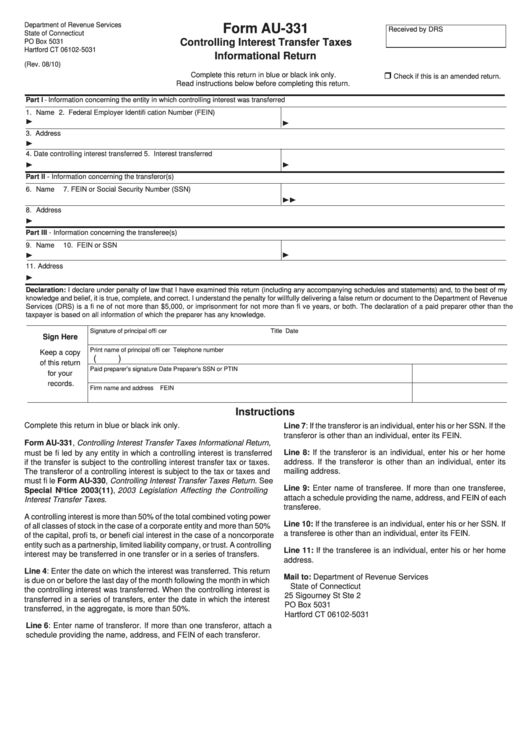

Form Au-331 - Controlling Interest Transfer Taxes Informational Return

ADVERTISEMENT

Department of Revenue Services

Form AU-331

Received by DRS

State of Connecticut

Controlling Interest Transfer Taxes

PO Box 5031

Hartford CT 06102-5031

Informational Return

(Rev. 08/10)

Complete this return in blue or black ink only.

Check if this is an amended return.

Read instructions below before completing this return.

Part I - Information concerning the entity in which controlling interest was transferred

1. Name

2. Federal Employer Identifi cation Number (FEIN)

3. Address

4. Date controlling interest transferred

5. Interest transferred

Part II - Information concerning the transferor(s)

6. Name

7. FEIN or Social Security Number (SSN)

8. Address

Part III - Information concerning the transferee(s)

9. Name

10. FEIN or SSN

11. Address

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue

Services (DRS) is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the

taxpayer is based on all information of which the preparer has any knowledge.

Signature of principal offi cer

Title

Date

Sign Here

Print name of principal offi cer

Telephone number

Keep a copy

(

)

of this return

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

for your

records.

Firm name and address

FEIN

Instructions

Complete this return in blue or black ink only.

Line 7: If the transferor is an individual, enter his or her SSN. If the

transferor is other than an individual, enter its FEIN.

Form AU-331, Controlling Interest Transfer Taxes Informational Return,

Line 8: If the transferor is an individual, enter his or her home

must be fi led by any entity in which a controlling interest is transferred

address. If the transferor is other than an individual, enter its

if the transfer is subject to the controlling interest transfer tax or taxes.

mailing address.

The transferor of a controlling interest is subject to the tax or taxes and

must fi le Form AU-330, Controlling Interest Transfer Taxes Return. See

Line 9: Enter name of transferee. If more than one transferee,

Special Notice 2003(11), 2003 Legislation Affecting the Controlling

attach a schedule providing the name, address, and FEIN of each

Interest Transfer Taxes.

transferee.

A controlling interest is more than 50% of the total combined voting power

Line 10: If the transferee is an individual, enter his or her SSN. If

of all classes of stock in the case of a corporate entity and more than 50%

a transferee is other than an individual, enter its FEIN.

of the capital, profi ts, or benefi cial interest in the case of a noncorporate

entity such as a partnership, limited liability company, or trust. A controlling

Line 11: If the transferee is an individual, enter his or her home

interest may be transferred in one transfer or in a series of transfers.

address.

Line 4: Enter the date on which the interest was transferred. This return

Mail to: Department of Revenue Services

is due on or before the last day of the month following the month in which

State of Connecticut

the controlling interest was transferred. When the controlling interest is

25 Sigourney St Ste 2

transferred in a series of transfers, enter the date in which the interest

PO Box 5031

transferred, in the aggregate, is more than 50%.

Hartford CT 06102-5031

Line 6: Enter name of transferor. If more than one transferor, attach a

schedule providing the name, address, and FEIN of each transferor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1