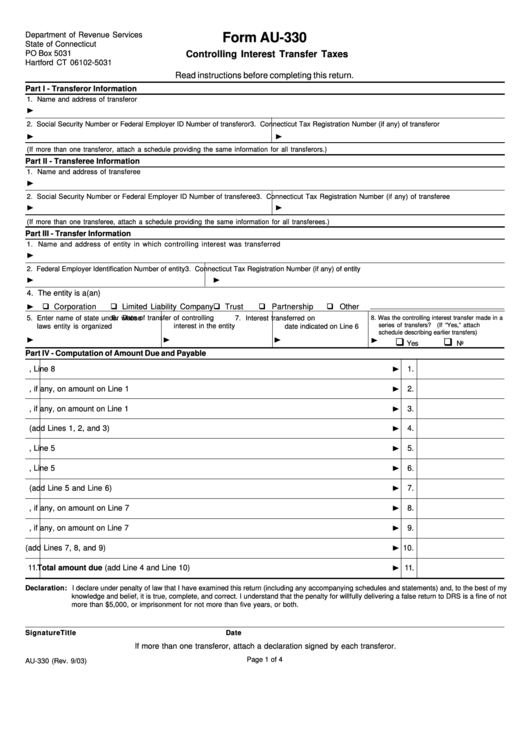

Form Au-330 - Controlling Interest Transfer Taxes

ADVERTISEMENT

Department of Revenue Services

Form AU-330

State of Connecticut

PO Box 5031

Controlling Interest Transfer Taxes

Hartford CT 06102-5031

Read instructions before completing this return.

Part I - Transferor Information

1. Name and address of transferor

K

2. Social Security Number or Federal Employer ID Number of transferor

3. Connecticut Tax Registration Number (if any) of transferor

K

K

(If more than one transferor, attach a schedule providing the same information for all transferors.)

Part II - Transferee Information

1. Name and address of transferee

K

2. Social Security Number or Federal Employer ID Number of transferee

3. Connecticut Tax Registration Number (if any) of transferee

K

K

(If more than one transferee, attach a schedule providing the same information for all transferees.)

Part III - Transfer Information

1. Name and address of entity in which controlling interest was transferred

K

2. Federal Employer Identification Number of entity

3. Connecticut Tax Registration Number (if any) of entity

K

K

4. The entity is a(an)

G Corporation

G Limited Liability Company G Trust

G Partnership

G Other

K

5. Enter name of state under whose

6. Date of transfer of controlling

8. Was the controlling interest transfer made in a

7. Interest transferred on

series of transfers?

(If “Yes,” attach

interest in the entity

laws entity is organized

date indicated on Line 6

schedule describing earlier transfers)

G

G

K

K

K

K

Yes

No

Part IV - Computation of Amount Due and Payable

1.

Enter amount from Part V, Line 8

K

1.

2.

Interest due, if any, on amount on Line 1

K

2.

3.

Penalty due, if any, on amount on Line 1

K

3.

4.

Subtotal (add Lines 1, 2, and 3)

K

4.

5.

Enter amount from Part VI, Line 5

K

5.

6.

Enter amount from Part VII, Line 5

K

6.

7.

Subtotal (add Line 5 and Line 6)

K

7.

8.

Interest due, if any, on amount on Line 7

K

8.

9.

Penalty due, if any, on amount on Line 7

K

9.

10. Subtotal (add Lines 7, 8, and 9)

K

10.

11. Total amount due (add Line 4 and Line 10)

K

11.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not

more than $5,000, or imprisonment for not more than five years, or both.

Signature

Title

Date

If more than one transferor, attach a declaration signed by each transferor.

Page 1 of 4

AU-330 (Rev. 9/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4